Mrs. Xiu Li Hawken has helped turn air raid shelters into thriving underground malls. Photos: iqilu, radiofoshan

Mrs. Xiu Li Hawken has helped turn air raid shelters into thriving underground malls. Photos: iqilu, radiofoshan

DURING THE COLD WAR, China dug out a series of subterranean bunkers to protect itself during uncertain times.

With geopolitics now having thawed considerably, Mrs. Xiu Li Hawken has helped turn many of these air raid shelters into thriving underground shopping centers, amassing a net worth of 2.2 billion usd into the bargain, making her the seventh richest woman in the UK -- though as a UK non-resident she is not in the country for more than 90 days per annum.

Mrs. Hawken in married to Mr. Tony Hawken of the UK, a teacher.

She was born in the broad-shouldered city of Harbin in China’s Northeast in 1964, an industrial center perhaps best known for its annual Ice Festival that draws visitors from around the world.

She is currently the main shareholder in Renhe Commercial Holdings Co Ltd (HK: 1387), which listed in Hong Kong in 2008.

Renhe Commercial Holdings currently operates 22 mainly subterranean shopping complexes in 15 metropolitan areas across the PRC. Photo: Renhe

Mrs. Hawken developed a love for football while in the UK – a sport which is growing ever more popular in Mainland China.

Mrs. Hawken currently also serves as squad manager of PRC-based football team Guizhou Renhe.

Perhaps an early love of the splendor of English Premier League stadia gave Mrs. Hawken an appreciation for architecture and commercial real estate on a grand scale, a calling that may have helped inform her future career path.

Property tycoon Mrs. Xiu Li Hawken is manager of PRC football team Guizhou Renhe. Photo: GZRH“My son loves football and we would often take him to see Premier League games in England.

Property tycoon Mrs. Xiu Li Hawken is manager of PRC football team Guizhou Renhe. Photo: GZRH“My son loves football and we would often take him to see Premier League games in England.

“Although I was very busy and had little spare time to see a lot of matches, I still couldn’t help but develop a deep appreciation for the magnificence of the football venues and the vibrancy of the sporting business,” she said in a Chinese media interview three years ago.

She said it was about this time, 1994 to be exact, that her younger brother, Mr. Dai Yongge, convinced her to return to her homeland and go into business making underground shopping centers.

And it was a few years later that this same sibling, also an avid football fan, suggested they invest in a PRC team of their own.

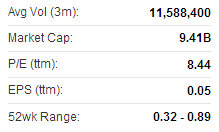

“However, my brother was a bit reluctant at first as he said we can do our best to control Renhe Commercial’s fate, but we can’t do much to control whether or not our team wins a championship,” Mrs. Hawken added. Renhe Commercial Holdings' recent Hong Kong share performance. Source: Yahoo Finance

Renhe Commercial Holdings' recent Hong Kong share performance. Source: Yahoo Finance

It wasn’t clearly written in the stars early on that Mrs. Hawken would one day become one of China’s richest self-made women.

She graduated from Heilongjiang University in China’s Northeast with a bachelor's degree in Chinese Literature in 1986 – not quite the tools needed to hammer out a commercial real estate empire later in life.

But it was her love of literature and fine writing that helped land her a job as a reporter at Harbin Daily, on a salary that a media piece on Ms. Hawken described as "meager." Harbin, hometown of billionaire Mrs. Xiu Li Hawken, is well known for its annual ice festival.

Harbin, hometown of billionaire Mrs. Xiu Li Hawken, is well known for its annual ice festival.

Photo: fengniao

Five years after getting her college degree, she found herself in London in 1991 where she took up a job in the city’s famous financial district.

There she met her future husband.

In 1994, having honed her business skills and financial savvy in London in the early 1990s, she decided to return to the PRC and go into business with her brother, converting air-raid shelters into underground shopping malls. Renhe recently 0.45 hkdDespite her powerful positions on the business and sporting stages, Mrs. Hawken remains an elusive subject for reporters, doing her best to keep a low profile all these years.

Renhe recently 0.45 hkdDespite her powerful positions on the business and sporting stages, Mrs. Hawken remains an elusive subject for reporters, doing her best to keep a low profile all these years.

The firm the brother-sister duo first laid the groundwork for in 1994 -- Renhe Commercial Holdings -- currently operates 22 mainly subterranean shopping complexes in 15 metropolitan areas across the PRC including fast-growing Tier II cities like Yueyang in Hunan Province and Wuxi in Jiangsu Province.

It turns out that much of the recipe for success for Mrs. Hawken’s innovative business idea had more to do with timing than any possible political or military connections.

Beginning in 1992, the Chinese leadership began to drastically loosen restrictions on Cold War-era bomb shelters for alternative use, and the founding of Renhe Group a short time later was auspicious timing indeed.

Mrs. Hawken currently helps guide Renhe Commercial’s executive directors in formulating company strategies.

In 2010, US private equity powerhouse Blackstone Group invested 600 million usd for a 30% stake in China (Shouguang) Agricultural Products Logistics Park, which is owned by Mrs. Hawken’s family.

Mrs. Hawken’s brother, Mr. Dai Yongge, is currently the chairman and CEO of Renhe Commerical, and Mr. Dai’s wife Mrs. Zhang Xingmei is also on the company's board.

Mid-last year, Renhe’s Hong Kong-listed shares took a 62% ytd tumble on economic stagnation at home.

But “China’s Lady Buffett” – Ms. Liu Yang of Atlantis Investment – remained upbeat at the time, emphasizing that she felt Renhe Commercial was fundamentally sound and was in her opinion the “best bargain” in the real estate sector.

See also:

DIANA CHEN: Steel Billionaire In Legal Tussle

For more on Mrs. Hawken, see:

http://www.hljnews.cn/fouxw_sn/2011-10/14/content_1081764.htm

http://sports.sina.com.cn/j/2010-05-13/20134983183.shtml

http://www.celebritynetworth.com/dl/hawken-xiu-li-net-worth/