Morgan Stanley: ANTA, BELLE Likely to Reward Shareholders

Morgan Stanley said that high levels of “excess cash buffer” support potential special dividends for Anta Sportswear (HK: 2020) and women’s footwear play Belle International (HK: 1880).

“Based on a systematic four-step screening process of our Chinese retail coverage universe, we believe Anta and Belle have ample financial strength to propose activities that could enhance the value of their shares in the upcoming earnings season,” Morgan Stanley said.

The research house said the two firms generate strong adjusted free cash flow, have high excess cash buffers on their balance sheets, and lack additional cash funding requirements in 2013 based on projections.

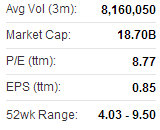

Anta - The company’s 2012 earnings suffered from an industry slowdown.

Adjusted FCF (i.e., operating cash flow – capex – regular dividends) was relatively low at 188 million yuan.

“However, we estimate that Anta still has over 3.96 billion yuan in “excess cash buffer” that could be deployed for special dividends,” Morgan Stanley said.

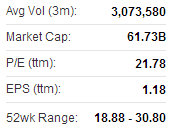

Belle - Morgan Stanley estimates that Belle generated about 1.2 billion yuan in adjusted free cash flow in 2012 and has an ample excess cash buffer of 1.2 billion.

“Given a strong financial position, we think it could also propose special dividends in the upcoming earnings season. We think the likelihood of proposing special dividends is higher for Anta than Belle.”

It added that many retailers continue to seek acquisition or expansion opportunities.

“Thus, both Anta and Belle have preferred to keep high levels of cash that could readily fund future acquisitions internally if opportunities arise. However, we see more potential acquisition opportunities for Belle than for Anta because of different industry dynamics.”

The research note added a positive correlation between share price and special dividend announcements.

“In prior one-month periods after special dividend announcements, Anta’s share price outperformed by 7%~43% and Belle’s by 5%~20%.”

Guoco: ‘Buy’ Call on WANT WANT

Guoco Research said it is assigning a “Buy” recommendation on snack food giant Want Want China (HK: 151).

The market researcher has given the Hong Kong listed enterprise a target price of 11.85 hkd (recent share price 10.74).

“Trends improved over the past month after forming a solid support at 10.14 hkd,” Guoco said.

Want Want China manufactures and trades rice crackers, snack foods, beverages and packing materials

The cut loss is 10.12 hkd and the consensus FY13 P/E is 27.1x.

Bocom: ‘Negative’ on CRE’s Kingway Brewery Pickup

Bocom Research said it is not especially bullish on a recent beverage acquisition by China Resources Enterprise (HK: 291).

Bocom is reiterating its “Neutral” call on CRE’s “unattractive valuation” with a 23.8 hkd target price (recent share price 26.9).

CR Snow Brewery (CRSB), 51% owned by CRE, announced its proposal to acquire all assets (except a plant and a plot of land in Shenzhen) of Kingway Brewery (HK: 124) for a consideration of 5.38 billion yuan.

“The move came as no surprise to us as the acquisition has been long awaited by the market. Our initial view is slightly negative, in view of the less visible synergistic effect and the seemingly aggressive pricing -- particularly when taking into account the slowing growth outlook of China’s beer sector and the operation being loss-making,” Bocom said.

The research house estimates the deal (assuming completion by 1Q13) will cut its forecast EPS for CRE by 3% in FY13E and FY14E.

“With CRE’s net cash of 3.8 billion yuan in FY13E, we believe internal financing can be well satisfied and a cash call is unlikely.”

See also:

Top HK Gainers & Losers In January

HK Stocks Still Smarter Choice Than Property

CHINA's REAL ESTATE & RETAIL: Latest Happenings...

Sumer: "Many Of My Property Stocks Have Performed Smartly In 2012"