Excerpts from DBS Vickers analysts' report

DBS Vickers urges investors of consumer stocks to be discerning

Analysts: Andy Sim, CFA, & Alfie Yeo

Following disappointing 3Q results, we have reduced revenue and net profit growth for consumer companies under our coverage.

Following disappointing 3Q results, we have reduced revenue and net profit growth for consumer companies under our coverage.

DBS Vickers urges investors of consumer stocks to be discerning

Analysts: Andy Sim, CFA, & Alfie Yeo

Following disappointing 3Q results, we have reduced revenue and net profit growth for consumer companies under our coverage.

Following disappointing 3Q results, we have reduced revenue and net profit growth for consumer companies under our coverage.We now expect FY13F/14F revenue growth of 4%/7%, from 6%/8% previously.

Coupled with expectations of weaker margins, we project a slower net profit growth of 4%/9% (from 18%/14%), for FY13F and FY14F respectively.

We advocate a selective stance on the Singapore consumer sector for 2014. Amid expectations of slower private consumption growth in 2014, we look to pick stocks for company specific factors, to outperform within the Singapore consumer space.

We have selected stocks with:

1) Stronger fundamentals and better resilience to softening revenue and margin compression;

2) Oversold companies at attractive valuations; and

3) Stable earnings and dividend payout.

1) Stronger fundamentals and better resilience to softening revenue and margin compression;

2) Oversold companies at attractive valuations; and

3) Stable earnings and dividend payout.

We like Osim (BUY, TP: S$2.60) for its growth profile and exposure to the North Asia market, Courts (BUY, TP: S$0.77) on expectations of recovery in 2014 and Del Monte (BUY, TP: S$0.82) for being oversold and the uncertainty of its proposed

acquisition being priced in.

We also like Sheng Siong (BUY, TP: S$0.80) for its defensive traits and yield profile.

We also like Sheng Siong (BUY, TP: S$0.80) for its defensive traits and yield profile.

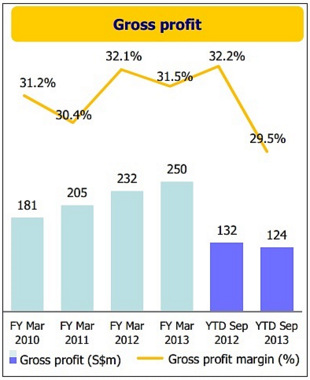

Decrease in gross profit (GP) and GP margin from YTD Sep 2012 to YTD Sep 2013 mainly due to (1) a shift in product sales mix from Furniture to IT products as IT products carry lower GP margins and (2) lower service charge income resulting from lower credit sales due to tightened credit sanctioning.

Decrease in gross profit (GP) and GP margin from YTD Sep 2012 to YTD Sep 2013 mainly due to (1) a shift in product sales mix from Furniture to IT products as IT products carry lower GP margins and (2) lower service charge income resulting from lower credit sales due to tightened credit sanctioning.  We believe Courts’ share price has more than factored in the negative aspects. Since 27 October, the counter has corrected 30% from S$0.83.

We believe Courts’ share price has more than factored in the negative aspects. Since 27 October, the counter has corrected 30% from S$0.83. With valuation at an attractive 9.9x FY15F PE, we believe the sell down could be overdone.

Its current share price implies a 32% total return upside to our TP, and PEG (FY14F–16F) looks compelling at c.0.5x.

While we project FY14F to be weak, we have projected 13.7% earnings growth for FY15F, driven by relaxation of credit tightening by the start of FY15F.

New stores opened in Malaysia will also contribute for a full 12 months next year.

New stores opened in Malaysia will also contribute for a full 12 months next year.

Maintain Buy with S$0.77 TP. Our forecasts are below consensus and we see limited downside risk at these levels, with our below consensus FY15F earnings estimate of S$33m.

Our TP is S$0.77, based on 13x FY15F PE.

Our TP is S$0.77, based on 13x FY15F PE.