Excerpts from analysts' reports

Voyage Research says there is a "huge price-value gap" in TriTech stock

Analyst: Ng Kian Teck

Tritech has begun production of marble at Hill 2B in Kelantan. It is working on a proposed listing of its Marble Resource Business on the HK Stock Exchange. Photo: Voyage ResearchWe invited Tritech Group Limited (Tritech) to our Chinese seminar two days ago and the management shared with our audience some of their recent developments.

Tritech has begun production of marble at Hill 2B in Kelantan. It is working on a proposed listing of its Marble Resource Business on the HK Stock Exchange. Photo: Voyage ResearchWe invited Tritech Group Limited (Tritech) to our Chinese seminar two days ago and the management shared with our audience some of their recent developments.

We also visited their quarry in Malaysia to get a better understanding about the current operations.

Voyage Research says there is a "huge price-value gap" in TriTech stock

Analyst: Ng Kian Teck

Tritech has begun production of marble at Hill 2B in Kelantan. It is working on a proposed listing of its Marble Resource Business on the HK Stock Exchange. Photo: Voyage ResearchWe invited Tritech Group Limited (Tritech) to our Chinese seminar two days ago and the management shared with our audience some of their recent developments.

Tritech has begun production of marble at Hill 2B in Kelantan. It is working on a proposed listing of its Marble Resource Business on the HK Stock Exchange. Photo: Voyage ResearchWe invited Tritech Group Limited (Tritech) to our Chinese seminar two days ago and the management shared with our audience some of their recent developments. We also visited their quarry in Malaysia to get a better understanding about the current operations.

In all, we are comfortable with the company’s operation and reckon that there is a huge price-value gap, if Tritech’s plans can bear fruits. We maintain our price target of S$0.880.

For the engineering division, Tritech has a stable order book of about S$83m, most of which are public sector jobs. The management reiterated on their underground specialty as an avenue for future growth and we believe this division will generate stable cash flow for the Group.

For the water division, Tritech is constructing a mega membrane processing plant with five factories in Qingdao.

Dr Jeffrey Wang, MD of TriTech. Photo: annual reportManagement envisage themselves to be a one-stop membrane related center and capable of providing engineering works on water and wastewater treatment plants, management of treatment plants and production of purifier and bottled water.

Dr Jeffrey Wang, MD of TriTech. Photo: annual reportManagement envisage themselves to be a one-stop membrane related center and capable of providing engineering works on water and wastewater treatment plants, management of treatment plants and production of purifier and bottled water.

They currently have 16 patented products which they intend to manufacture as the factories get completed. They also recently acquired Anhui Clean Environmental Biotechnology Co. Ltd to leapfrog their position in the water treatment business in China.

Dr Jeffrey Wang, MD of TriTech. Photo: annual reportManagement envisage themselves to be a one-stop membrane related center and capable of providing engineering works on water and wastewater treatment plants, management of treatment plants and production of purifier and bottled water.

Dr Jeffrey Wang, MD of TriTech. Photo: annual reportManagement envisage themselves to be a one-stop membrane related center and capable of providing engineering works on water and wastewater treatment plants, management of treatment plants and production of purifier and bottled water. They currently have 16 patented products which they intend to manufacture as the factories get completed. They also recently acquired Anhui Clean Environmental Biotechnology Co. Ltd to leapfrog their position in the water treatment business in China.

We visited Terratech Resources’ quarry last week and saw the actual extraction of marble from the hills.

Tritech has begun production on Hill 2B and Hill 3 and we reckon that they can expand the capacity by about four fold towards the end of next year. Though we are left impressed with Tritech’s venture into the water and resource businesses, we noted that the water division is still at the start-up stage and we need to see if Tritech can sell their products in China and other markets.

Tritech has begun production on Hill 2B and Hill 3 and we reckon that they can expand the capacity by about four fold towards the end of next year. Though we are left impressed with Tritech’s venture into the water and resource businesses, we noted that the water division is still at the start-up stage and we need to see if Tritech can sell their products in China and other markets.

The same applies to the marble division. That said, the division recently entered into contracts to sell marble and related products worth about S$17.95m to China.

Credit Suisse expects Yangzijiang's strong order momentum to continue

Analysts: Gerald Wong, CFA and Louis Chua

We expect a mild commercial shipbuilding upcycle in 2014, driven by vessel prices that are close to trough, as well as a sustained recovery in the global economy.

A growing order backlog for yards should be positive for newbuild prices, which have improved 4.0% since troughing in May 2013. With its strong financial position, we expect Yangzijiang to benefit disproportionately from the recovery in newbuild orders. Yangzijiang has secured US$2.63 bn of contracts as of 13 Nov, representing 88% of our 2013 forecast of US$3.0 bn.

We expect another US$2.4 bn of orders for the company in 2014, as Yangzijiang has 30 options outstanding worth US$1.48 bn, including options with Seaspan for nine 10,000 TEU containerships.

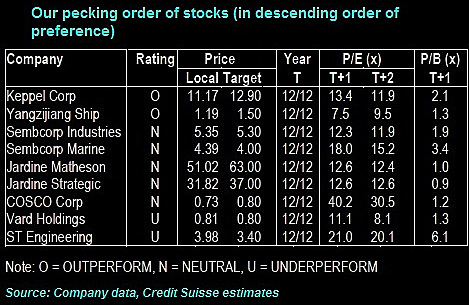

Credit Suisse's picks in the Singapore capital goods sector, as at Nov 28.

Credit Suisse's picks in the Singapore capital goods sector, as at Nov 28.Recent story: DEUTSCHE's top picks for 2014: ComfortDelGro, Genting, Yangzijiang, DBS, Golden Agri