Excerpts from analysts' reports

CIMB highlights likelihood of maiden dividend from China Minzhong

Analysts: Kenneth Ng, CFA, & Lee Mou Hua

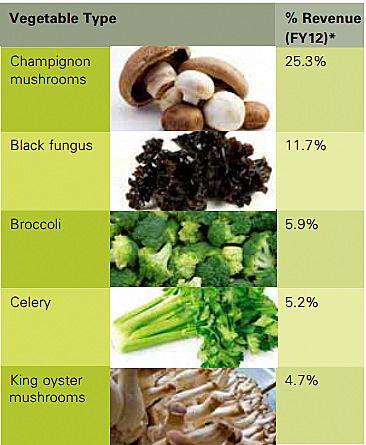

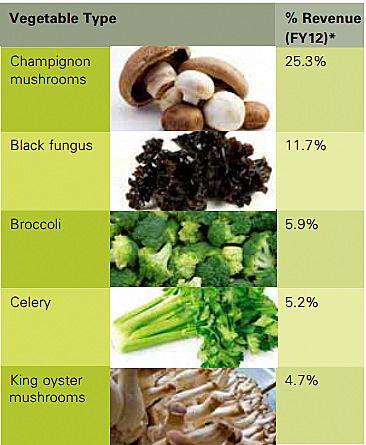

*As a % of total revenue less sales of mushroom spores, bamboo related products and branded processed products. Image: annual reportMinzhong’s investor relations manager, Dave Tan, participated in CIMB’s annual Asia Pacific conference in Kuala Lumpur on 19-20 June. The key takeaways from his meeting with investors are:

*As a % of total revenue less sales of mushroom spores, bamboo related products and branded processed products. Image: annual reportMinzhong’s investor relations manager, Dave Tan, participated in CIMB’s annual Asia Pacific conference in Kuala Lumpur on 19-20 June. The key takeaways from his meeting with investors are:

1) it will be the cultivation business rather than the processed business that will drive earnings. And to capitalise on this, it will be ramping up industrialised farming facilities. Management is targeting to open three new facilities in Tianjin, Jiangsu and Sichuan.

2) Indofood is likely to get a board seat but this tie-up will take time to yield significant impact on earnings. Supply contracts for the processed business can be achieved within six months but the potential JV to build cultivation facilities in Indonesia will take time.

3) The board is seriously considering paying dividends in FY13 but nothing is firm yet. It is possible that Minzhong will look to match Indofood’s 40% payout over time. FY13 operating cash flow is guided to be about Rmb700m-800m.

CIMB highlights likelihood of maiden dividend from China Minzhong

Analysts: Kenneth Ng, CFA, & Lee Mou Hua

*As a % of total revenue less sales of mushroom spores, bamboo related products and branded processed products. Image: annual reportMinzhong’s investor relations manager, Dave Tan, participated in CIMB’s annual Asia Pacific conference in Kuala Lumpur on 19-20 June. The key takeaways from his meeting with investors are:

*As a % of total revenue less sales of mushroom spores, bamboo related products and branded processed products. Image: annual reportMinzhong’s investor relations manager, Dave Tan, participated in CIMB’s annual Asia Pacific conference in Kuala Lumpur on 19-20 June. The key takeaways from his meeting with investors are: 1) it will be the cultivation business rather than the processed business that will drive earnings. And to capitalise on this, it will be ramping up industrialised farming facilities. Management is targeting to open three new facilities in Tianjin, Jiangsu and Sichuan.

2) Indofood is likely to get a board seat but this tie-up will take time to yield significant impact on earnings. Supply contracts for the processed business can be achieved within six months but the potential JV to build cultivation facilities in Indonesia will take time.

3) The board is seriously considering paying dividends in FY13 but nothing is firm yet. It is possible that Minzhong will look to match Indofood’s 40% payout over time. FY13 operating cash flow is guided to be about Rmb700m-800m.

What We Think: The key re-rating catalysts will be Indofood getting a board seat and dividends. These two events should ease corporate governance concerns.

Although free cash flow in FY13 will be low given management guidance that free cash flow will hit a below-expectation Rmb1bn, we think dividends are still possible because of Indofood’s Rmb455m cash injection. A 10% payout would translate into a

yield of 2.2%.

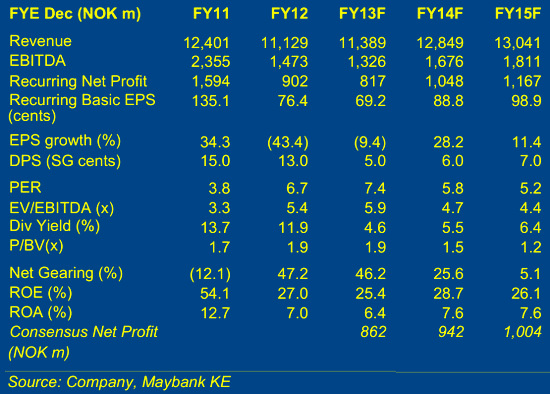

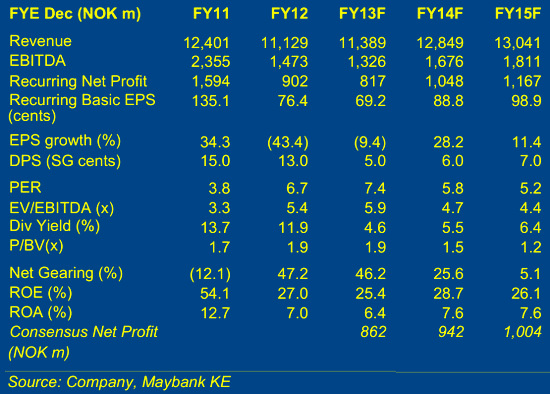

Maybank Kim Eng says Vard Holdings has most attractive valuation among O&M stocks

Analyst: YEAK Chee Keong, CFA

Vard’s share price is off its low of SGD1.015 following an unwarranted selldown previously. While there are some easing of concerns over margins and order intake, further rerating would need to be triggered by real order wins which we believe would gather pace towards 2H13.

Vard has the most attractive valuations among the O&M stocks under our coverage, trading at 5.8x FY14F PER, 5-6% forward dividend yields and FY13-15F ROEs of >25%.

Reiterate Buy and TP of SGD1.65.

We raise out target price to ($1.27) a 10% premium to sector average (4.5x CY14 P/E).

Recent story: Case for privatisation of DUKANG DISTILLERS, CHINA MINZHONG, 7 others

Recent story: Case for privatisation of DUKANG DISTILLERS, CHINA MINZHONG, 7 others

Maybank Kim Eng says Vard Holdings has most attractive valuation among O&M stocks

Analyst: YEAK Chee Keong, CFA

Vard’s share price is off its low of SGD1.015 following an unwarranted selldown previously. While there are some easing of concerns over margins and order intake, further rerating would need to be triggered by real order wins which we believe would gather pace towards 2H13.

Vard has the most attractive valuations among the O&M stocks under our coverage, trading at 5.8x FY14F PER, 5-6% forward dividend yields and FY13-15F ROEs of >25%.

Reiterate Buy and TP of SGD1.65.