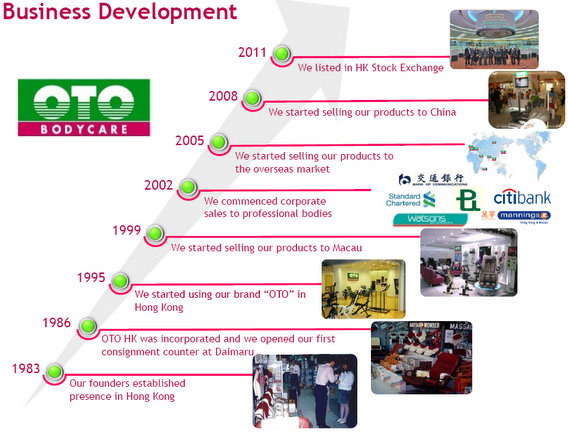

OTO HOLDINGS Ltd (HK: 6880), a leading developer and retailer of health and wellness products in Hong Kong and a keen rival of Singapore's Osim International, has an insurmountable 65% market share in the territory and is going all out to expand into Mainland China.

And while OTO's financials took a noticeable hit recently, the maker of a wide range of products meant to make us feel better is feeling better itself about prospects down the road.

With a rapidly rising product portfolio count of massage chairs, e-stim kits, blood pressure monitor and a host of other relaxation, fitness, therapeutic and diagnostic products now standing at 84, the Hong Kong-listed firm is a well-known name among those who care about physical fitness and wellness.

OTO is expanding rapidly across the region, with 76 total retail outlets – 33 in Hong Kong/Macau and 55 in the 1.3 billion consumer-strong People’s Republic of China.

Another 11 outlets were planned in the PRC by March of next year.

With expansion of both products and markets always at the forefront of its growth strategy, OTO was also looking to diversify its customer base, senior management told investors at an Aries Consulting-sponsored meeting in Hong Kong.

“Our main target market remains the home use sector, but we are also pursuing institutional clients such as physical therapy clinics, hospitals, rehab centers, health clubs, gyms and sports teams – both professional and collegiate,” said OTO’s CEO Charlie Yip.

Mr. Yip said that OTO also corporate sales, which contributed 12% to the interim (April-September) top line, were also a major revenue driver for the company.

“Gifts from corporate sales clients like banks represent value channels for repeat customers to be created. In fact, overall, most of OTO’s customers are repeat customers,” he added.

Mr. Yip said key corporate clients include Bank of Communications, HSBC, DBS, Hang Seng Bank, Watsons, Citibank, Mannings and Bank of China.

“Our PRC sales are mainly corporate sales,” he added.

Chinese companies traditionally reward deserving employees with presents or gift certificates, and OTO Holdings is more than happy to ink these long-term recurring contracts in exchange for memberships which offer 10-15% discounts.

Investors present at the investor meeting in a conference room high above Hong Kong’s central business district got a taste of the gift giving practice firsthand, as OTO executives handed everyone a portable, miniature electric stimulation (e-stim) massage unit to take the tension out of whichever muscle group was ailing them.

To this end, OTO’s Executive Director David Yip told NextInsight that the company did follow a “Three Ms” strategy (miniaturization, mobility and multi-functionality) of sorts when brainstorming for new products in its cutting edge R&D facilities.

The pocket-sized e-stim unit was case in point, meeting the first two “M-s” – miniaturization and mobility.

“We certainly take conditions on the ground into consideration in our product design stage. For example, our typical home-use Hong Kong customer has a smaller living space than counterparts in Mainland China.

“Therefore, we would target some of the smaller products (massage chairs, exercise equipment) to the less roomy Hong Kong apartments,” he said.

The Executive Director added that miniaturization and mobility was givens in terms of being factored in during the R&D process.

However, multi-functionality did not always come so easily to OTO’s product line.

“Our medical-oriented products, especially our diagnostic products, typically are uni-purpose, and many of our ‘partial body massage equipment’ (targeting necks, shoulders, arms, waists, feet, etc) are specifically designed for a particular body area, so multi-functionality is not feasible in many cases,” he said.

Despite the aggressive product portfolio enhancement and geographic expansion, OTO still struggled of late due largely to the more sluggish economic growth in the region.

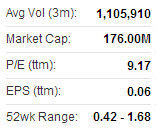

OTO’s April-September six month revenue grew 5.1% year-on-year to 124.3 million hkd.

While the firm was pleased with the top line expansion in a slower economic growth climate, they did note that the revenue growth this half was slower than last year’s 18.1% increase.

Net profit for the period was down nearly 62% year-on-year at 4.8 million hkd, mainly due to higher operating costs and more reluctant consumer spending amid the sketchy economic outlook.

Staff costs over the period shot up 51.9% year-on-year to 24 million hkd, mainly due to a rise in headcount to 250 at end-September from 153 a year earlier.

OTO also saw rising costs in advertising (1.3 mln hkd higher) and commissions paid to consignment counters in shopping centers and department stores (5.1 mln hkd higher).

Following OTO’s April-September earnings announcement, Bocom said it was maintaining its “Neutral” recommendation on the health, fitness and wellness products maker, with a target price of 0.53 hkd (recently 0.55).

“During the period, OTO experienced a very challenging business and operating environment due to prolonged uncertainties in global economic conditions.

“The slowdown trend in the PRC’s economic growth weakened overall consumer buying sentiment , particularly in Hong Kong and the PRC markets,” said OTO Chairman Yip Chee Seng.

The Chairman added that OTO fared better than luxury sector goods – products generally hit hard during a period of slower economic growth – but that buying sentiment was generally down across the board.

“Although our health and wellness products are comparatively less correlative as those of luxury goods to the general economic conditions, our overall revenue still slowed.”

The PRC consumer market remained the main focus of OTO’s growth strategy in its retail network.

“Asia, and especially Mainland China, are showing more vibrant demand growth trends, and the home-use sector in this region will still be our main market impetus,” Executive Director David Yip said.

See also:

China Retail Rundown; XTEP ‘Buy’; ANTA Mixed

XTEP ‘Buy’; Bocom Downbeat; MAGIC Shines; PAX Impresses

XTEP Kicking Things Up A Notch; CHOW SANG SANG Target Hiked