SINGAPORE MOVIEGOERS are no doubt familiar with Orange Sky Golden Harvest (HK: 1132).

The Hong Kong-listco operates the Golden Village cinema chain which has a commanding 43% market share in Singapore.

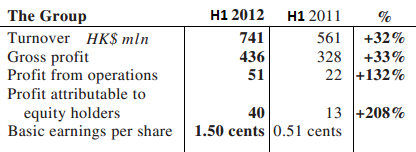

And thanks to strong growth in Greater China, Orange Sky Golden Harvest’s first half net profit more than tripled to over 40 million hkd.

OSGH had a blockbuster first half, with January-June net profit soaring 208% year-on-year to 40.1 million hkd.

During the period, OSGH's revenue and gross profit rose 32% and 33%, respectively, to 741 million hkd and 436 million hkd.

OSGH's combined box office receipts (including Hong Kong, Mainland China, Taiwan and Singapore) totaled 934 million hkd, a 28% growth compared to the first half of 2011.

The growth was attributable to robust operating performance from cinema operations in Mainland China and continued improvement elsewhere.

Mao Yimin, Executive Director & CEO of OSGH, said: "China's cinema business is experiencing the fastest growth rate in the region, driven by soaring box-office takings.

“People in China are becoming more willing to spend on superior movie watching experiences, with pulsating soundtracks, high-density resolution and 3D images.”

Mr. Mao added that OSGH is not slowing down anytime soon.

“We will continue to expand our cinema network in Mainland China to grasp these growth opportunities. In the meantime, OSGH will also be proactively launching its comprehensive Chinese language film business to make a larger contribution to the Chinese film industry."

Gross margin increased by 0.5 percentage point to 58.9%, from 58.4% in the first half of 2011.

In the first half, OSGH maintained its business focus on its key priority growth market of Mainland China.

The Hong Kong-listed firm reported gross theatre takings of 142 million yuan in Mainland China, representing an increase of 99% over the first half of 2011.

Admissions in Mainland China rose 90% to over 3.7 million.

OSGH's gross theatre takings growth outperformed that of the total market in Mainland China, largely due to contributions from newly opened cinemas.

For the first half of 2012, Mainland China recorded urban area box office receipts of 8.1 billion yuan, representing a yearly increase of 42%.

Since the beginning of the year, OSGH opened seven new cinemas with a total of 51 screens in Beijing, Shanghai, Xi'ning, Chengdu, Dalian, Changzhou and Zhongshan.

At latest count, OSGH operated 34 cinemas with 248 screens across Mainland China.

The company said it will continue to leverage on its well-established "Golden Harvest" brand to expand its cinema operations in Mainland China.

For the second half of 2012, OSGH will continue to open new cinemas in order to grab more market share in this high-growth market.

The Group's overseas operations delivered a solid operating performance for the period.

In Taiwan, Vie Show Cinema Co Ltd, of which OSGH is an individual major shareholder, generated NTD1.64 billion in gross theatre takings for the period, an increase of 40% compared with the first half of 2011.

Admissions grew 34% to approximately 6.7 million.

Vie Show's market share in Taipei was approximately 43%.

Vie Show contributed about 21 million hkd in net profit to the Group, an increase of 35% year-on-year.

In Singapore, the Group's 50%-owned "Golden Village" cinema chain contributed a net profit of 25 million hkd for the period, roughly the same as last year.

"Golden Village" is the market leader in Singapore with a market share of 43%.

For the period, OSGH's cinemas in Hong Kong achieved theatre takings of 93 million hkd (H12011: 82 million hkd).

OSGH maintains a Hong Kong market share of around 12%.

Regarding film production operations, the Group will reproduce the classic film "Fly Me to Polaris" in the second half of this year.

As the first reproduction to start up the Group's "Orange Sky Golden Harvest Reproduction of Classic Movie Series" this year, this new "Fly Me to Polaris" will be directed by the original director Jingle Ma and will adopt Sony super high resolution 4K digital filming techniques, a pioneering attempt in China.

The Group targets a grand release around Valentine's Day 2013.

Orange Sky Golden Harvest Entertainment (Holdings) Ltd. (the "Group" or "OSGH") is the world's premier Chinese language film entertainment company, and is primarily engaged in film production, financing, distribution and exhibition. The Group currently operates 61 multiplexes with a total of 464 screens across Mainland China, Hong Kong, Taiwan and Singapore and is one of the leading distributors in its operating territories. The Group's cinema chains View Show in Taiwan and Golden Village in Singapore are the largest in their respective markets with market shares of around 43%.

See also:

CHINA'S SILVER SCREENS: 'Precious Metal' For GOLDEN HARVEST

HK Flicks, Footwear & Financiers: Latest Happenings...

GOLDEN HARVEST: Singapore Top Cinema Play's Profit Up 37% On PRC Story

GOLDEN HARVEST Eyes PRC Big Screens