SBI E2-CAPITAL: MING FAI Still ‘Buy’ On ‘Attractive Retail Business’

SBI E2-Capital said it is maintaining its ‘Buy’ call on Ming Fai International Holdings Ltd (HK: 3828).

“Ming Fai has a good stable existing hotel and airlines amenities business and an attractive retail business thats beginning to take shape,” the research note said.

The hotel-related business currently accounts for 81.1% of total sales and 60.7% of net profit.

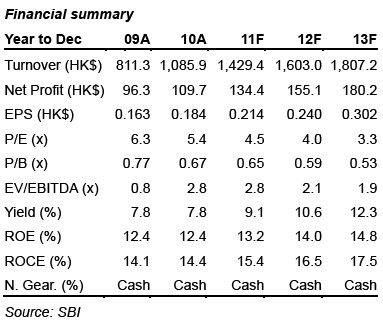

“We feel that the retail business has a potential of becoming a significant contributor along with Ming Fai‟s existing expertise. And the counter is trading at an undemanding valuation of 4.5x FY12/11F P/E,” SBI E2 added.

The group recently announced the proposed buyback of 8.5% of issued share capital of “All Team” – a wholly-owned subsidiaries of the group.

All Team is principally engaged in the manufacturing and distribution of cosmetics and fashion accessories in the PRC, also known as “7 Magic - 七色花”.

On August 31, 2010, the group acquired the entire issued share capital of All Team for a consideration of 250 mln yuan.

SBI E2 said its target price of 1.80 hkd for Ming Fai represents 7.5x FY12/12F P/E and 5.9x FY12/13F P/E.

See also:

MING FAI: Hotel & Airline Supplier Has Standout 1H, Yet Shares At 52-Wk Low

MING FAI: World’s Top Supplier To Hotels, Airlines Charging Ahead On Travel Boom

MING FAI Targets 2,000 PRC Cosmetics Stores This Year

ORIENTAL PATRON: ‘Positive Stance’ On CHINA TIANYI

Oriental Patron says is upbeat on orange juice giant China Tianyi Holdings Ltd (HK: 756).

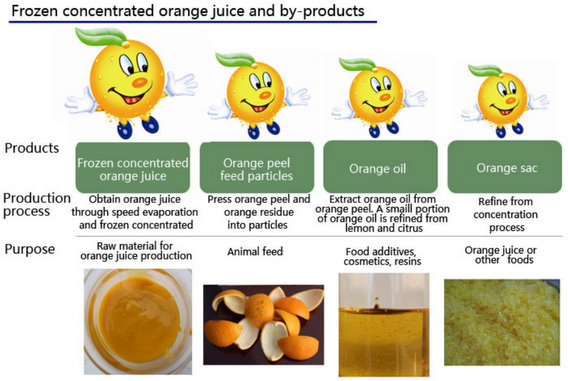

“We hold a positive stance on earnings outlook because domestic FCOJ (frozen concentrated orange juice) supplies only fulfill ~25% of demand in China, translating a shortfall of domestic FCOJ supplies and underpins demand potential is high.

“Also Tianyi enjoys a competitive advantage of FCOJ prices, ~10% lower than imported and it is undergoing an expansion of cultivation bases which empowers Tianyi to enhance upstream supplies of raw materials for FCOJ processing.”

It added that having a market-leading 18.5% market share in China enables Tianyi better bargaining power and the firm also has a very good footprint exposure in China’s top three FCOJ processing regions (i.e. Chongqing, Fujian, and Hunan).

“Tianyi had fruitful recent results on higher volume sales and an ASP hike,” Oriental Patron said.

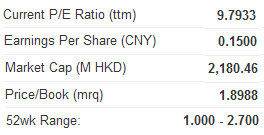

Tianyi’s 1H12 (Y/E: 30.June) net profit came in at Rmb175mn (+34% yoy) on revenue of Rmb320mn (+53% yoy), thanks to capacity expansion, sales volume growth and an ASP hike of fruit juice products.

Recurrent profit actually jumped over 60% to approximately Rmb140mn.

“We believe the supportive measures from the government in fruit processing industry development should helps support Tianyi to gain more market slices as a substitute for imports,” the research note concluded.

See also:

JUICED UP: CHINA TIANYI Crushing Peers In PRC Orange Juice Market

DUKANG: 2Q2012 Net Profit Up A Whopping 55% At Rmb 94.4m

VITASOY: Stronger Revenue/Profit Growth Expected From 1Q12 Onwards

FOOD FOR THOUGHT: WANT WANT, TINGYI Noodle Blue-Chip Bound