Translated by Andrew Vanburen from a Chinese-language blog by redmonkey.cn in Quamnet

MAINLAND CHINA-BASED movie theater owners have seen a 290% ROI since 2005 and box office receipts in the PRC surged 29% last year to 13.1 bln yuan.

One blockbuster – Transformers 3 – alone accounted for a whopping 1.1 bln yuan.

However, China’s 1.3 bln people only spend an average of 10 yuan per capita each year on the cinema experience.

So what are the main culprits behind Hong Kong-listed cinema shares failing to keep pace with the strong ticket receipt growth?

One hurdle is the strength of perception over reality.

There is a perception in the PRC – not exactly borne out by the facts – that cinemas are suffering greatly from the plethora of pirated film DVDs as well as online knockoff versions.

But I believe that once investors realize the true scale of the cinema market potential in the PRC – a fast growing box office revenue outlook and still untapped spending by consumers – then movie theater plays will certainly become much more popular.

First, let’s take the pulse of the Mainland movie theater market. What are people paying to watch?

As mentioned above, Transformers 3 topped the box office receipts list in 2011, raking in some 1.1 bln yuan, followed by Kungfu Panda 2 with 610 mln, the Christian Bale film Flowers of War stood at 490 mln, Pirates of the Caribbean with 460 mln, and martial arts action drama The Flying Swords of Dragon Gate pulled in 430 mln.

Anyone waiting in line to watch a popular film on a Friday or Saturday night better be prepared to stand for the long haul.

This can only mean that if the average per capita cinema expenditure is just 10 yuan per year, there is surely huge upside potential for what can only be described as a largely untapped market, especially in the Tier II and III cities, and in Mainland China’s hinterlands.

When the film studios and cinema operators join hands to jointly market their wares to these huge sprawling markets, then the days of laggard share prices for theater plays will soon become a thing of the past.

Furthermore, the current ownership structure for the lion’s share of movie theater operators could be tilted more in their favor without unnecessarily upsetting the apple cart.

With every movie showing, cinemas are in fact selling a product, and that product is a story.

However, half of the story’s windfall often goes into the pockets of the real estate developer – typically a large retail shopping complex – in a normal joint-profit sharing arrangement.

While 50% would be the maximum that movie theater operators have to siphon off of each box office ticket to satisfy their landlords, this arrangement still scares a good number of investors away who see the deal as unfairly skewed in the property owner’s favor.

We all know that shopping malls have been hot tickets these past few years, with their listed entities generally outperforming the benchmark index.

So if the two sides can renegotiate the terms of their profit-sharing arrangements, with shopping centers and malls giving a nod of appreciation to the fact that many “shoppers” are first lured into their facilities with the idea of first seeing the latest film, then I believe both sides will benefit in a more equitable way from the surging growth in China’s domestic consumption story.

After all, cinemas have a story to tell, and moviegoers and lining up like never before in the PRC to hear their stories.

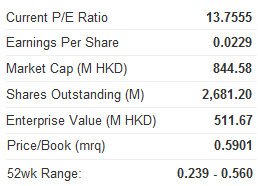

Speaking of stories, one listed cinema operator that is buying into the China growth story in a big way is Orange Sky Golden Harvest Entertainment (Holdings) Ltd (HK: 1132).

It operates 34 multiplexes with 261 screens in Hong Kong, Mainland China, Taiwan and Singapore.

The Hong Kong-listed firm’s activities include film and video distribution; film exhibitions/theater operations in Hong Kong, the PRC, Taiwan and Singapore; films and television programs production; and the provision of advertising and consultancy services in Mainland China.

Due to startup costs affiliated with building new upscale movie theaters in Mainland China, the firm’s bottom line has underperformed of late.

But Golden Harvest is I believe a perfect example of a stock well-positioned to ride the movie-going boom in China, once the market is more fully exploited.

See also:

GOLDEN HARVEST: Seeing Gold In Silver Screens

Supply-Side Pride As MING FAI Named HK ‘Outstanding Enterprise’