SOLARGIGA ENERGY Holdings Ltd (HK: 757), a manufacturer of monocrystalline silicon for solar energy generation systems, is shifting to a more defensive posture to ensure a sunnier future.

The global solar industry is entering a hibernation phase of sorts as a result of over production of monocrystalline silicon, with current global production capacity at around 50GW but only 22GW of demand expected next year.

A UBS Solar Energy Report estimated the reduction in selling prices and excess supply will lead to widespread consolidation in the following year. At the same time, it is expected that many Chinese small-sized and second-tier firms will eventually be forced to shut down.

But this does not necessarily mean extended cloud cover for Solargiga, as the firm is capitalising on the downturn to further vertically integrate its business at lower costs.

As China’s largest manufacturer of monocrystalline silicon solar ingots and wafers -- important components for solar generation systems-- Solargiga also decided to expand its downstream business aggressively.

The net profit margin of its current downstream businesses (photovoltaic cells, modules and system installations) is only 0.8%.

The company said this strategic move, while perhaps not very profitable on its own, will allow Solargiga to provide a “one-stop” solution for clients, hence providing greater bargaining power on sales margins as a whole.

Competition on the Quality Front

The ongoing solar industry slowdown will inevitably lead to stiff price competition. The management of Solargiga believes the quality of its products and its sales network will become the key factors determining survival over the anticipated two-year industry “hibernation.”

N-series high efficiency products, currently their key offerings, are expected to become one of their main weapons to help withstand the challenges over the coming years. Normal P-type mono's conversion efficiency is at around 18%, and N-type can be up to 22-23%.

Saving Now for the Future

Solargiga currently has production capacity for silicon solar ingots, silicon solar wafers, solar cells and photovoltaic modules of 1000MW, 900MW, 300MW and 150MW, respectively.

Management decided to cut back its capital expenditure by 93% from this year’s budget of 530mln yuan to 40mln for the following year, given that the market is facing a surplus in components and parts for solar generation systems.

As a result, the saved capital will be used to expand Solargiga’s downstream production capacity -- namely module and system installations -- which will increase from the current level of 150MW to 250MW by next year.

The expansion of the downstream segment could realize full vertical integration in the photovoltaic industry for Solargiga.

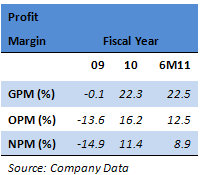

For the six months to June 30, 2011, the company reported turnover of 1.274 bln yuan, up 60% year-on-year, while gross profit was up 201.6% at 287 mln yuan.

The overall margin increased to 22.54% due newly launched exports to the UK and Germany as well as strong demand growth in sales to Japan. Net profit rose 179.5% 112.8 mln yuan, with the net gearing ratio standing at 79.7%.

Recent story: SOLARGIGA, China’s No.2 Monocrystalline Maker, Prefers Quality To Quantity