The oil & gas sector is beginning its next upcycle, according UOBKH analysts Nancy Wei and Tan Junda in a report dated 10 Sep.

Firm oil prices are fueling exploration and production (E&P) work, the offshore supply vessel (OSV) glut has ended and charter rates are trending up.

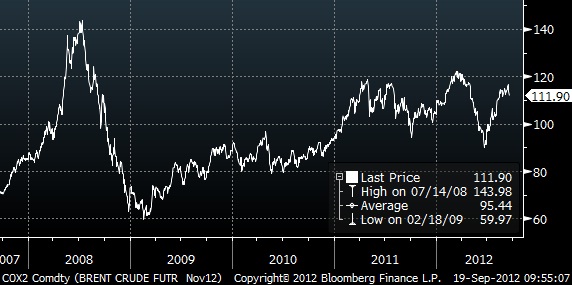

In the past two years, crude oil prices have remained mostly above US$100 per barrel, compared to below US$100 during 2009 to 2010. The recovery in oil price yields higher earnings to oil companies.

With oil prices above levels conducive for investments (US$80 per barrel), global E&P expenditure is estimated to rise by 9% this year.

This in turn spells more jobs for offshore and subsea contractors that undertake platform, pipeline and subsea installation, and inspection, repair and maintenance work.

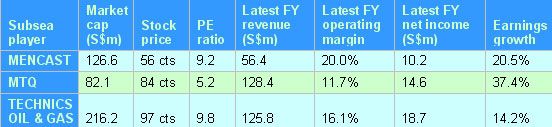

These players include Mencast, MTQ, Technics Oil & Gas, Dyna-Mac, Heatec Jietong, Kruez, Mermaid Maritime and Baker Technology.

Here we feature three players with strong earnings growth in the past year.

Mencast – MRO player for offshore

Take Mencast for example. From being a vessel sterngear manufacturer and solutions provider, its top line has leaped with its transformation into maintenance, repair and overhaul solutions provider that also caters to the offshore sector.

Just a year after acquiring three businesses for its offshore & engineering segment, the segment's 1H2012 revenue doubled year-on-year to S$22.4 million and contributed 64.6% to top line.

Group net profit attributable to shareholders rose 27.7% to S$6.9 million.

The acquired businesses includes services such as:

* Top Great Engineering & Marine - Inspection, maintenance and fabrication of offshore structures as well as engineering and other services related to onshore structures, provided by the newly acquired.

* Unidive - Diving services for subsea inspection, repair and maintenance

* Team International Development and Team Precision Engineering - Manufacturing of metal precision components

Its offshore & engineering order book as at 30 June 2012 was S$17.8 million, compared to S$10.2 million a year prior to this.

Related story: MENCAST: Transformed, And Taking Off In Oil & Gas Industry

MTQ – Expands offshore product range via M&A

MTQ is another oilfield solutions provider with strong earnings growth.

It is the authorized working partner for some of the world’s largest original equipment manufacturers in drilling equipment and the leading independent supplier of turbocharger and fuel injection parts and services in Australia.

Group revenue for the quarter ended 30 June 2012 (1QFY13) increased by 57% year-on-year to S$38.4 million, after it expanded its product range significantly by acquiring the Premier Group, another authorized agent of well-known oilfield equipment.

The Premier Group contributed about 30% to MTQ revenue in 1Q FY13.

Net profit attributable to shareholders was up more than twenty-fold (up 1,955%) at S$4.7 million.

The sharp increase was in part due to cost management measures it took and startup costs in the previous year when in forayed to Bahrain.

In FY2011, MTQ also took a 12% equity stake in Neptune Marine Services, a leading subsea engineering solutions/ services provider with a presence in Australia and the United Kingdom.

Related story: @ MTQ AGM: Insights Into Bahrain And Neptune Prospects

Technics Oil & Gas – High dividend yield

Technics is a leading full service integrator of compression systems and process modules for the global offshore oil and gas sector.

It has been improving its profitability by targeting subsea projects.

Last month, it completed the acquisition of a yard in Vietnam to expand its market share there.

The company is also likely to receive a cash injection when its Gretai listing plans for a subsidiary, Norr Offshore, materializes.

Net profit after tax for the nine months ended 30 June 2012 (9M2012) was up 32% year-on-year at S$21.0 million.

Based on its recent stock price of 96 cents, it has a generous dividend yield of 8.25%.

Order books were S$85 million as at 18 July.

Related story: TECHNICS: 9M2012 Net Profit Up 32% At S$21m; 8-Ct Dividend At 8% Div Yield