RICH MAINLAND CHINESE who live in the north of China and yearn for a home away from home in the summer are the target of a timesharing scheme offered by Singapore-listed Weiye Holdings.

Weiye is a leading property developer in Henan, a province in central China, with a track record of more than 10 years.

It listed on the SGX Mainboard on 16 August 2011 via a reverse takeover of Kyodo-Allied Industries.

Since 2009, it has been implementing a “home away from home” scheme on Hainan, a tropical resource-rich island off the southern tip of China that is almost 50 times the size of Singapore.

Riding on Hainan's boom

The island has been developing rapidly since the Chinese government began to actively promote it as an international tourist destination in 2009.

It now has two international airports and a high-speed train along its east coast linking the northern and southern tips of the island to the airports.

Construction of its west coast railway commenced in June 2011 and will be ready in 2015.

Last year, 31.5 million tourists visited Hainan, up 13% year-on-year. Most of these were domestic tourists.

And the tourists are spending more now. Tourism revenue was up 25% at US$4.3 billion.

“There is pent-up demand for our timeshare homes from Northerners whose quality of life suffers from being cooped up at home for a large part of the year,” said executive chairman Zhang Wei during an exclusive interview with NextInsight recently.

People living in Liaoning, Jilin or Heilongjiang, where temperatures average zero or below, yearn for hot and wet tropical climates.

There is also growing Russian demand for Hainan holidays, with tourist numbers up 53% last year.

About 28% of international tourists to Hainan last year came from Russia, where temperatures average sub-zero for a good 5 months of the entire year.

But with more than one thousand hotels in Hainan, wouldn't holiday makers prefer to book a hotel instead?

"Weiye's package for holiday makers is innovative and competitive," said Mr Zhang.

Firstly, 5-star hotels in its top tourist cities don’t rent cheap, with room rates comparable to Singapore hotels.

Secondly, real estate prices have skyrocketed in Hainan’s airport cities of Haikou and Sanya just like the first-tier cities on the mainland, and Weiye's projects provide 4 to 5-star resort living at more affordable cities.

”When you buy our homes, you get membership privileges for food, accommodation, transportation, travel, shopping and entertainment,” said Mr Zhang.

Member perks such as discounts of up to 70% and priority booking for retail, transportation or sight-seeing destinations are made possible as Weiye has tied up with more than one thousand merchants operating on the island.

Government regulation hits bottom line

Real estate developers are currently holding back project launches after the government hit hard on real estate speculation.

This may be the reason the Group made a net loss of Rmb 1.2 million for 2Q2012, generated from property sales of projects in Henan (Weiye Central Park and Weiye Xiang Di Bay) as well as Hainan (Weiye Costa Rhine).

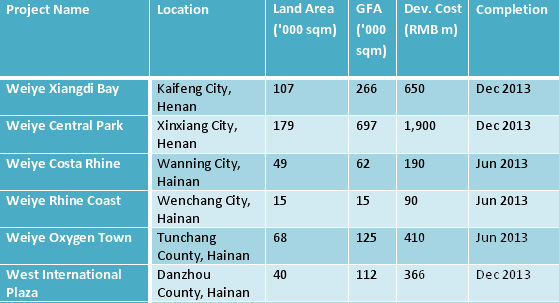

Its current pipeline consists of four projects in Hainan and two projects in Henan, making up a total gross floor area of over 1.2 million sq m. See details in the table below.