News in brief....

Olam International: AMID SOME skepticism among investors regarding its prospects, its CEO has stepped into the market to buy 1 m shares for his own account.

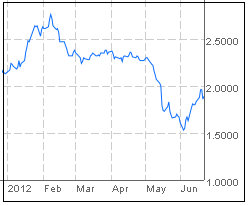

Sunny George Verghese paid an average of $1.8589 per share on Monday (June 25).

As a result, he now owns 110,646,477 shares, or a 4.62 % stake, worth around $205 million.

A substantial shareholder, Kewalram Singapore Limited, has also made a 1-m share purchase on Monday followed by another 2 million shares on Tuesday, raising its stake to 20.21%.

To top it off, Olam also bought back its own shares on Monday and Tuesday: 2 million and 2.5 million, respectively.

With that, Olam's share buyback has now reached 42,196,000 shares in the short space of three weeks.

The share buyback has helped perk up the share price - from $1.67 to close at $1.875 yesterday.

Olam had announced that it may purchase up to 10% of its issued shares (excluding treasury shares), or up to 244,230,986 shares. It's a massive S$450 million, going by current prices.

Olam will buy at a maximum of 105% of the average closing price of the last 5 market days at the time of acquisition.

All shares purchased may be held as treasury shares or cancelled.

Maybank Kim Eng Research cautioned that the share buyback is not necessarily a positive move -- Olam already has a net gearing of 189%, instead of being in a net cash position with idle money.

The brokerage has a sell rating on Olam shares with a target price of S$1.43.

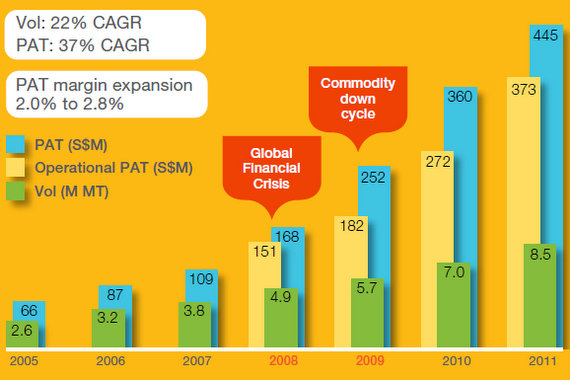

On the other hand, DMG & Partners has a target price of $2.56, saying that Olam is buying back shares at P/Es close to the trough in Mar 2009, in the midst of the global financial crisis.

Samko Timber: As the company's operating results improved with each passing quarter, a substantial shareholder has been accumulating Samko shares.

Since June 2011, when it had 543,009,305 shares, Sampoerna Forestry Limited has bought 13,665,000 shares of Samko, a leading timber processing company in Indonesia.

Sampoerna Forestry -- which is owned by one of the richest families in Indonesia - now holds a 39.72% stake.

Samko's recent 1Q profit of Rp27.5 billion (about S$3.9 million) was the most profitable of the past five consecutive quarters of profitability.

Recent story: SAMKO TIMBER: Turnaround story with 5 quarters of profit