Photo: Andrew Vanburen

HONGGUO INTERNATIONAL Holdings Ltd (HK: 1028), which quit the Singapore capital market last year to relist in Hong Kong this year, says shop numbers and selling price protection are both its primary objective to surviving and then thriving in the hypercompetitive stomp-or-be-stomped women’s footwear industry.

After first hanging its shingle on the Singapore exchange in 2003, after seven years of somewhat disappointing share price performance, Hongguo’s controlling shareholders put forward an offer to buy back all issued and paid-up ordinary shares of the Nanjing-based firm.

After a period of market limbo, Hongguo relisted on the main board in Hong Kong on September 23 of this year, raising some 148 mln usd into the bargain.

“Despite the bearish market sentiment, we went ahead with the IPO plan,” said Hongguo Investment Manager Hanson Wu.

Hongguo, which produces shoes mainly for overseas customers including Nine West and Guess, said it will spend 40% of the Hong Kong listing proceeds to expand its retail network, and another 25% on acquiring peer firms.

Hongguo, China's second largest retailer of women's formal and casual footwear after fellow Hong Kong listco Belle, has several self-developed brands including C.banner, EBLAN, Fabiola and Naturalizer, with Sundance to be launched soon.

“We expect nothing but continued growth of ladies footwear under our brands,” said Mr. Wu.

“And beginning in the first half of next year, we will begin opening independent stores selling at average unit price of 1,200-1,500 yuan, which constitutes a high-end market, similar to what Stella Luna does,” he said of one of the firm’s top domestic rivals.

Hongguo’s IPO proceeds from its Hong Kong listing will come in handy as it hopes to add between 400-600 new retail shops to its 1,300 strong store network across China, which will include both proprietary and third-party outlets.

“We’ll continue to expand the wholesale and retail network by opening more proprietary outlets and third party retail outlets. In the third quarter alone we raised our proprietary store count by 15.8%. By the end of each year through 2011 to 2013, our targeted net increase of proprietary outlets is approximately 220 to 320,” he said, adding that the firms also plans to sell its products through third-party online platforms.

“We’ll also develop our own online platform for selling products when the time is ripe.”

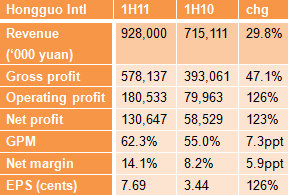

As can be seen from the earnings table above, the first half was kind to Hongguo, with growth in gross profit attributable to an increase in selling price and “effective” cost control, the company said.

"Our strategically-located network keeps us fully updated on changing customer needs, to which we are able to respond quickly because of our well-controlled, vertically integrated business model to manage our key operational chains, including design and development, sourcing, manufacturing, marketing, distribution and sale of our products,” Mr. Wu said.

Hongguo operates three production facilities in Nanjing, Dongguan in Guangdong Province and Suining in Jiangsu, as well as an R&D center in Guangdong’s Foshan, where over 200 R&D personnel work in dedicated teams to drive the product development of each brand, he added.

“To keep up with demand, we have six production lines each in Nanjing and Dongguan.”

Part of the company’s success in controlling costs was the age old Chinese institution of guanxi.

“We already enjoy a decade-long relationship with our joint venture firm as well as our key supplier,” Mr. Wu said.

He also said the company was in good hands from a leadership and visionary standpoint.

“With our experienced management team driving our growth, we are carefully carrying out a number of important business strategies to extend our leading position in China's mid-to-premium women’s footwear market. These include improving same-store sales growth, expanding our retail and distribution network, further developing multi-brand portfolios, and making selective acquisitions which create synergies.

“Collectively, we believe these business strategies will elevate the future of Hongguo to new heights.”

Hongguo’s self-developed brands and licensed brands products are mainly distributed through department stores and independent retail stores in different cities across the country, ranging from first-tier to third-tier cities.

Hongguo also acts as an OEM or ODM manufacturer for international shoe brands dealing in export markets.

As of June 30, Hongguo’s retail and wholesale networks spread across 31 provinces, autonomous regions and municipalities in the PRC, with 1,071 proprietary retail stores 373 third-party stores.

See also:

MISS ASIA Contestants Lend ‘Hand’ To China’s Top Slipper Play

BAOFENG: Aiming To Crystallize New Orders With Swarovski

Photo: CMS

CMS PHARMA: Doubles Profit, Boosting Drug Portfolio

CHINA MEDICAL SYSTEM Holdings Ltd (HK: 867) saw its interim bottom line nearly double to 30 mln usd, thanks in large part to the introduction of new pharmaceutical products to the market as well as a rapidly expanding sales network.

The firm mainly engages in M&As also with the intention of winning distribution rights in the PRC, and was keeping its eyes open for attractive assets both at home and abroad with the ultimate aim of controlling distribution of popular drugs in the world's most populous country.

And management says what worked in the past is likely to work in the future.

Therefore, the Shenzhen-based firm is keeping a close eye out for attractive pickups amid an aggressive M&A campaign in a fragmented but fast-growing market.

“We fully realize that Mainland China’s pharmaceutical industry is very decentralized and fragmented. Therefore we are of course on the lookout for promising acquisitions to not only boost our product portfolio, but in turn expand our marketing base,” CMS Investor & Media Relations Officer Gaby Yu told a large gathering of investors in Shenzhen.

“If the targeted firms make sense, and are not too far from our core focus, then why not?” she added.

As for the company’s core focus, it would remain concentrated upon developing and/or acquiring popular, profitable leading-edge pharmaceutical products.

“Yes, we do realize that TCM (traditional Chinese medicine) products are growing in popularity, especially overseas, but our focus has and always will be on Western medicines,” Ms. Yu said.

The past half year was a healthy one for the drug firm.

“Despite the volatile market conditions in China, we recorded significant growth in the January-June period,” Ms. Yu said, once again proving that some industries like health care and basic foodstuffs often show signs of resilience during economic slowdowns.

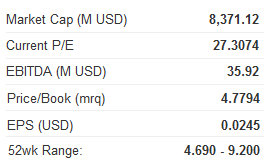

For the six months ended June 30, sales rose 57.4% year-on-year to 96.3 mln usd, leading to a net profit growth of 95% to just under 30 mln.

“With appropriate product positioning, strategic planning and execution, we saw remarkable performance. From the first half of 2007 to the first half of 2011, the compound annual growth rate of revenue was 41.6%, and the CAGR of net profit achieved 84.0%,” CMS said earlier.

Ms. Yu picked up her pharmaceutical knowledge on the job, an impressive achievement considering the sector is constantly transforming itself.

"My background is in management and finance, and I picked up the information I needed to know about medicine and pharmaceuticals after joining CMS," she said.

Cardiovascular, gastrointestinal, pulmonary, and a range of cancer-related drugs make up just a few of CMS’s broad portfolio of direct network and agency network-sold pharmaceuticals.

Photo: CMS

As of June 30, the company’s direct network had over 1,000 sales, marketing and promotion professionals.

Meanwhile, the agency network has close to 1,000 independent third party sales representatives or distributors.

The sales coverage spans over 13,000 hospitals throughout China, of which over 7,400 hospitals are being covered by the direct network.

CMS was very interested in non-organic expansion.

“Aside from products development and network expansion, the corporate acquisitions in the first half of 2011 also greatly advanced our development.

"For example, in April we acquired Great Move Enterprises Ltd and its subsidiaries.”

Two of the biggest revenue earners within the firm’s direct network include Danish-developed Deanxit, used for the treatment of mild to moderate depression and anxiety.

In the first half, Deanxit recorded sales of 31.4 mln usd, up 20.5% year-on-year, accounting for 32.6% of CMS’s turnover.

Meanwhile, German-developed gallstone and liver disease drug Ursofalk saw first half revenue of 20.9 mln usd, up 23.6%, contributing 21.7% to the total top line.

The German and Danish products remain CMS's top distributed drugs in China.

China Medical System Holdings Ltd (CMS) is a pharmaceutical services provider based in Shenzhen, China. It focuses on marketing promotion and sales of prescription drugs to all therapeutic departments in hospitals.

The group was established in 1995, and was listed on AIM in London in June 2007, and then listed on Hong Kong's main board on September 28, 2010 while being delisted from AIM at the same time.

See also:

Ex-SGX Listco SIHUAN, SINO BIOPHARM: Downturn-Resistant Firms Get ‘Buy’ Call Initiations

HAIER, SHANGHAI PHARMA Among Stocks On Cusp Of Comeback?