Isaac Chin, 62, (in Vienna, above) made his money from property and stock investing - and he and his wife travel frequently to enjoy diverse cultures in Europe and Asia. Photo courtesy of Isaac.

For the past decade, Isaac Chin has been a full-time investor after a career as a chartered accountant. “I didn't have an inspiring career as an accountant. Nothing great came out of it. If I have to work hard for a salary and put up with a lot of stress, I might as well work for myself - and earn more,” he said.Now aged 62, he has reaped handsome profits from investing in property, equities and bonds.

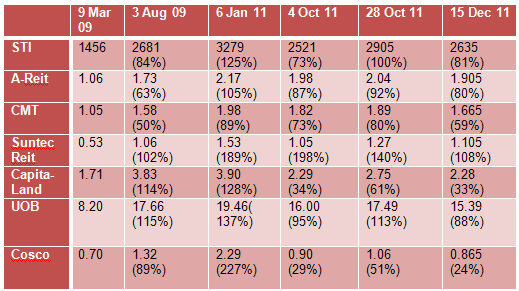

Percentage figures in brackets refer to the change since the low point on 9 March 2009. Source: Isaac Chin

The above statistics speak volumes. A few important points:

1. The Straits Times Index recovered strongly 5 months after hitting the bottom on 9 March 09 but has remained range-bound 2500-3300 to date. This looks like a re-play of the stock market debacle in 1929; the market strongly recovered intially, only to slide into a Great Depression.

2. Of late, REITs have out-performed property heavyweight CapitaLand. Despite daily reports of rising prices of newly-launched properties, there is a decline of about 40% in CapitaLand share value since Jan 2011.The present phenomenon is abnormal. It implies that either CapitaLand is oversold or there is a bubble in the physical property market in Singapore.

3. Reits are currently yielding an average 7% p.a. about 540 basis points over the SGS 10-year bonds and above the 5.7% inflation in Singapore in Nov 2011.

To date, Reits have declined as much as STI in percentage terms. Any further fall in Reits' prices will only make their yields even more attractive, hence providing a good incentive for long term investment in them, especially when the borrowing cost is so low.

3. Reits are currently yielding an average 7% p.a. about 540 basis points over the SGS 10-year bonds and above the 5.7% inflation in Singapore in Nov 2011.

To date, Reits have declined as much as STI in percentage terms. Any further fall in Reits' prices will only make their yields even more attractive, hence providing a good incentive for long term investment in them, especially when the borrowing cost is so low.

The Singapore market is holding up well so far due to our strong financial reserves but the STI can drop to 2400 or lower if the Euro-Zone crisis turns into a pandemonium.

Other observations:

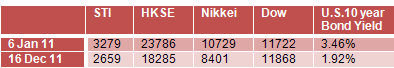

a. The Dow appears to have outperformed our regional markets but the U.S $ has devalued against Asian currencies. Overall all financial markets are hurt in 2011.

a. The Dow appears to have outperformed our regional markets but the U.S $ has devalued against Asian currencies. Overall all financial markets are hurt in 2011.

b. In 2007, condos in Upper Bukit Timah were selling $300 p.s.f (average). Today, these condos in the same locations are selling $1,000 p.s.f.

At the moment there is a property bubble which will be deflated in the next few years with over-supply of completed housing projects all over the island and a slowing global economy.

Paul Volcker, former U.S.Fed Chairman, told his audience in a seminar on world economy that all the econometrics and financial engineering have failed as Economics is simply not an exact science like Physics.That explains the current dichotomy between equity valuation and market price.

For 10 years, 2000-2010, I achieved a compounded growth rate of 15% p.a. but suffered a 10% decline for the first time in 2011.

I am comfortable with my current balanced portfolio: 18% in corporate bonds yielding 4.5% p.a., 32% in Reits, Insurance, Cash and 50% in properties.

Conclusion:

At the moment there is a property bubble which will be deflated in the next few years with over-supply of completed housing projects all over the island and a slowing global economy.

Paul Volcker, former U.S.Fed Chairman, told his audience in a seminar on world economy that all the econometrics and financial engineering have failed as Economics is simply not an exact science like Physics.That explains the current dichotomy between equity valuation and market price.

For 10 years, 2000-2010, I achieved a compounded growth rate of 15% p.a. but suffered a 10% decline for the first time in 2011.

I am comfortable with my current balanced portfolio: 18% in corporate bonds yielding 4.5% p.a., 32% in Reits, Insurance, Cash and 50% in properties.

Conclusion:

In my 12 years as a private investor, 2011 has proven to be the most difficult. But investing has always been intriguing, challenging, defying all precise predictions as several elements of mathematics, economics,and behaviorial science are involved.

I have often used charting and mathematical models as tools to help in my daily trading activity. Keeping abreast with current affairs, political, economic and financial development around the globe is essential too as good decisions must always come with a coherent macro - micro view.

As an ordinary person, I have been very fortunate that 90% of my bets were correct so far. I attribute this high success rate to sound knowledge, skill, judgment and timely execution. I believe successful Investment also demands patience, discipline and tenacity.

As an ordinary person, I have been very fortunate that 90% of my bets were correct so far. I attribute this high success rate to sound knowledge, skill, judgment and timely execution. I believe successful Investment also demands patience, discipline and tenacity.

It tests, and demands a lot from, one's character. I consider myself fortunate because aside from financial independence, I am still healthy and happy.

The recent arrival of my first grand-child makes me feel that I have come full circle. And I have a few other nice things to look forward to: I am now planning for my next holiday in Spain in March, and Norway and Denmark in Oct 2012.

The recent arrival of my first grand-child makes me feel that I have come full circle. And I have a few other nice things to look forward to: I am now planning for my next holiday in Spain in March, and Norway and Denmark in Oct 2012.

Recent story: ISAAC CHIN: 'I pulled out from equities 2 months ago, no regrets'