This article was recently published on Calvin Yeo's blog, www.investinpassiveincome.com, and is reproduced and updated with permission.

LIPPO MALL RIGHTS were issued on 10th November as part of a capital raising exercise to fund 2 acquisitions in Indonesia - Pluit Village in Jakarta and Plaza Medan Fair in Medan.

The rights opened at $0.089 and traded down all the way to $0.045, closing at $0.031 yesterday. Rights are basically a call option to buy the stock at a particular strike price, and if not exercised by expiry date, it becomes worthless.

Now with a strike price of $0.31, the rights present a great opportunity to buy in at a big discount: $0.31+$0.031 = $0.331 per unit, which is at a discount to the $0.36 that the REIT closed at yesterday.

Back of the envelope calculations suggest that the forward dividend yield based on this rights price should be more than 9.2%, which is extremely high for a retail REIT.

As the date to expiry, which is 18th Nov 2011, draws closer, the time value of the rights depreciate rather quickly, which is the reason the rights will become cheaper as it nears expiry.

However, the intrinsic value of the call remains, which is the ability to buy the mother share at strike price of $0.31 - that’s worth something as the value is definitely worth above that.

Other than the high dividend yield, there are other aspects of the REIT which are pretty captivating.

Firstly, the leverage ratio is only at 12% post transaction and that means a huge debt headroom for further acquisitions or Asset Enhancement Initiatives (AEI)s without further equity raising.

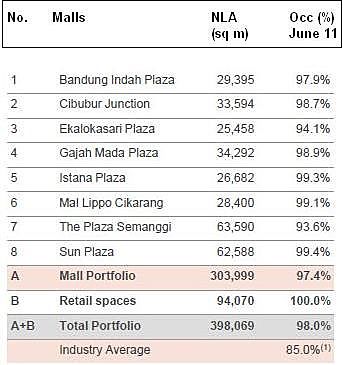

Secondly, the properties are investment grade, with very high occupancy at an average of 98% and relatively long Weighted Average Lease Expiry (WALE) of 5.3 years.

There is also good diversification where no property accounts for more than 16% of the total income and the top 10 tenants account for less than 31% of income. All in all, it means highly defensive income streams with conservative leverage - the REIT will be able to withstand any major turbulence in the world economy.

Indonesia has recorded one of the highest growth rates in Asia when other economies slipped during the recent financial crisis.

The malls are located in major cities such as Jakarta and Medan to capture the huge growing urban population and expanding middle class who are hungry for the retail experience with their new-found wealth.

I have been to some of these malls in Jakarta and Medan recently and I must say I am impressed with the tremendous progress from the last time I visited more than 5 years ago. The Indonesians have tremendous spending power and the malls are there to fulfill their needs with Starbucks and other luxury brands.

Credit availability such as credit cards and credit lines have also largely boosted retail spending. Given the continuous flooding at other ASEAN regions like Thailand, Vietnam and Philipines, Indonesia is likely to be an indirect beneficiary as they are direct competitors for foreign direct investments (FDI)s.

Given the positive aspects of the country’s growth and the location of these malls, I believe Lippo Mall has the potential to continue to excel.

It is also important to note that the sponsor Lippo Group, founded by Mochtar Riady, is one of the largest conglomerates in Indonesia, focusing on property, retail and many other investments.

We can continue to see good deal flow for Lippo Malls and debt financing should not be an issue. Lippo Group is also the sponsor of First REIT, a highly successful healthcare REIT also listed in Singapore.

I have invested in the Lippo Mall REIT earlier and bought more rights from the open market at prices ranging from $0.057 to $0.035. I don’t think there is another retail REIT offering the same type of yield as Lippo Mall is offering now. You may want to seriously consider it. However, if you are not familiar with Indonesia, then you may skip this investment.

Resources on Lippo Mall:

http://lmir.listedcompany.com/newsroom/20111020_190137_D5IU_A56DC5BEF2CC99EE4825792F002F4861.1.pdf

http://lmir.listedcompany.com/newsroom/20111003_083933_D5IU_5C15BF1B65DE8DAC4825791D0083184A.1.pdf