Benjamin Graham and David Dodd, widely considered to be the fathers of modern investing philosophy, had a deep affinity for value stocks.

They taught disciples such as Warren Buffett to assess companies in the most pessimistic possible scenarios. This makes sense.

These men wrote their famous book, Security Analysis, in 1934, when companies were liquidating at a fast pace during the Great Depression.

One of their favourite techniques: Net/net investing.

This looks at what a company would be worth in a time of absolute distress.

Specifically: what would a company have left if you piled up its cash, inventory and accounts receivable, paid off its liabilities and returned the funds to shareholders?

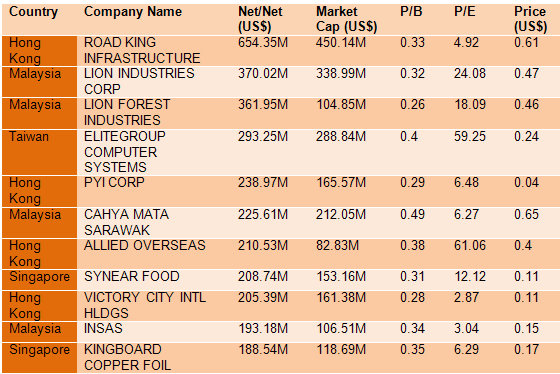

AsiaPacFinance.com picks out 11 stocks which have Net/net amounts larger than their market capitalization.

Yes, these companies are undervalued: if you take all their current assets and less of total liabilities, you end up with a value larger than their current market capitalization!

Glenn Ho is Director at AsiaPacFinance, serving retail investors globally through Research, Trading Strategies, and Investment Seminars. The financial portal collaborates with banks and brokerages by providing technical analysis and investor education across asset classes. AsiaPacFinance is also the first company to invent a stock screener that combines both fundamental and technical analysis. You can reach Glenn at AsiaPacFinance.