Excerpts from latest analyst reports....

OSK-DMG, after plant visit, spells out catalysts for WORLD PRECISION MACHINERY stock

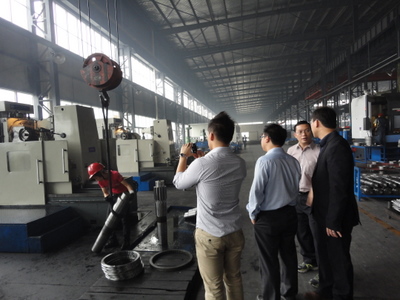

We visited World Precision Machinery’s manufacturing facilities in Danyang city, Jiangsu. Company is a leading metal stamping machine supplier with 8% share of the domestic market. Its stamping machines are used in the manufacture of cars, white goods and train bodies.

It makes more than 200 kinds of stamping machines under its World brand for customers such as Haier, Chery Automotive, Honda and BYD. Recently, the group also made inroads into the railway engine component space, clinching contracts to supply to China’s state-owned train manufacturer China CNR Corp.

Price drivers. Catalysts for the stock include:

1) Building of a new manufacturing facility in Shenyang to extend its geographical reach and enabling it to serve the cluster of automotive customers in northern China. The new plant also enables it to save on logistics costs;

2) management expects more orders in the railway sector and expects this new segment to account for 5-10% of sales in 1-2 years’ time;

3) The group is a conglomerate with the listed company forming only 10% of group sales. Potential injection of unlisted businesses within the group in the farming equipment, construction machinery and car parts will raise the scale and profile of BWPM.

Based on consensus estimates, the stock is trading at 6.4x FY11 P/E and 5.6x FY12 P/E. The consensus target price of $0.99 implies upside of 78% from current levels. The company has paid good dividends in the past two years, amounting to 100% payout of FY09 earnings and 38% of FY10 earnings.

Recent story: WORLD PRECISION MACHINERY, CHINA MINZHONG, OKP, ARMARDA: What analysts now say.....

Nomura points to positive effect on BIOSENSORS of Johnson & Johnson's exit from drug-eluting-stent biz

Analyst: Lim Jit Soon, CFA

Johnson & Johnson’s announcement that it will quit the drug-eluting-stent business will, we believe, be positive for Biosensors as it gains more share in markets like the EU, Japan and others outside the US.

There could also be opportunity to hire sales and technical staff to augment its expansion.

We continue to maintain a Buy rating for Biosensors. Price target: $1.50

Deutsche Bank says outlook unexciting for dry bulk shipping sector as oversupply persists

Deutsche Bank holds a dim view of the prospects of the dry bulk shipping sector.

In a report, analysts Joe Liew, CFA, and Sky Hong, CFA, noted that year to date dry bulk shipping rates have been weak.

Reason: the newbuild supply that has come onstream. The analysts continue to expect supply growth (6.4% this year and 11.7% next year) to outstrip demand growth over 2011-2012E.

Thankfully, there has been a recent uptick in scrapping numbers leading to a cut in Deutsche's estimate of supply growth in 2011 from 15.9% to 14.4% .

They have cut earnings forecasts to reflect the lower rate environment.

In fact, the container shipping sector isn't look pretty either.

"Earnings outlook this year for both dry bulk shipping and container shipping is poor. In container shipping, we expect a decline in rates and an increase in costs to result in sector earnings to collapse in 2011E."