Dukang Distillers Holdings Ltd (SGX: DKNG) had a stellar January-March, with revenue rocketing up 156% y-o-y to over 515 mln yuan and bottom line growing 127% to over 75 mln.

Meanwhile, the baiju liquor maker, which distills a potent Chinese-style white wine, began selling TDRs in Taiwan in March.

The firm has a major presence in its home market of Henan – China’s most populous province.

However, Dukang’s shares are currently flirting with 52-week lows.

Last week NextInsight and several fund managers were in Zhengzhou to meet with management as part of our 'Discover the Dragon' series of visits to various companies in China.

Part and parcel of the liquor maker’s decision to sell TDRs in Taiwan earlier this year was an attempt to shake and wake its valuation, diversify its shareholding base and introduce the Dukang name to the Taiwan market.

The March 9 listing raised proceeds of nearly 270 mln yuan which Dukang primarily used to fund expansion at its Luoyang Dukang operations, about two hours outside the Henan provincial capital of Zhengzhou.

This included quickly doing something about the fact that at newly-acquired distillery, around half of the 2,968 fermentation pools were not in use.

But at TDR listing time, the company’s Singapore-listed shares fell by over a third and have been near 52-week nadirs ever since.

However, Dukang is pushing ahead with its exploration of partnership opportunities with a major Taiwan-based liquor enterprise, with the products under the proposed arrangement to be sold under the “Dukang” name targeting both the Taiwan and PRC markets.

To further this effort, Dukang has also set up a representative office in Taiwan to facilitate future business operations as well as to serve as a platform for potential expansion into the rest of Asia, notably Japan and Southeast Asia.

The company currently realizes the bulk of its baiju sales in Henan Province, producing and marketing liquor products under the Dukang and Siwu brand names.

Siwu was a 2005 pickup, which Dukang followed upon by launching an aggressive brand-building and capacity expansion campaign for its newly-acquired sister brand.

An even more recent addition to the Dukang umbrella of brands was Jiuzu Dukang, which was officially launched in April of this year, positioning itself as Dukang’s iconic premium product series.

“The acquisition marked the culmination of a year’s diligent efforts following intensive market research, fine-tuning of product taste and innovative packaging,” said Dukang Distillers Deputy Chairman and CEO Zhou Tao.

He said the company’s premium product was differentiated from others within the offering portfolio by adjusting the age of the grain alcohol used as well as the fermentation pools utilized.

“This is our top-end baiju product, with prices per 500 ml reaching above 500 yuan for some vintages,” Mr. Zhou said.

Management said that baiju, which according to legend was accidentally invented by Du Kang nearly 2,000 years ago after he left sorghum and other grains to ferment in a hollowed out tree, is a highly fragmented undertaking in Mainland China.

“Therefore, marketing and promotions are extremely important to succeed in this crowded sector.”

To this end, Dukang Distillers held its second annual trade fair on May 18 during which it introduced Jiuzu Dukang to existing and potential distributors.

“Turnout of over 1,500 was around 50% higher than the inaugural fair last year, and we successfully added over 60 new distributors, amounting to a total of approximately 170 currently,” Mr. Zhou added.

He said that a crucial development to come out of this fair was market diversification, as the company still relies on the nearly 100 million-strong population of home province Henan for the bulk of its sales.

“The fair last month saw over half of our newly-added distributors hail from outside of Henan Province. This allows Dukang to expand into new markets, including the city of Tianjin, and distant provinces including Guangdong, Guangxi, Heilongjiang and Gansu.”

He said that in addition to trade fairs and trade conferences, which he called “crucial,” the company also relied on billboards, banners, CCTV ads, print ads and mass transit ads to spread Dukang’s brand nationwide and boost recognition of the company’s name.

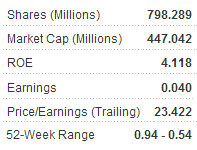

Chart: Bloomberg

In addition to raising brand awareness, the company of course had to handle the brick and mortar aspects of meeting growing market demand.

“Since May 2010, we have been embarking on an extensive exercise to upgrade production facilities, including significantly increasing production output of self-produced grain alcohol and reviving the remaining fermentation pools for continued utilization.”

As an indication of the company’s rapid expansion, over the past four successive quarters, grain alcohol output has totaled (in tonnes): 288, 347, 1,025 and 1,175, respectively, with current production capacity standing at 2,410 tonnes for the just-concluded quarter (7,610 tonnes per year) with a 49% utilization rate.

Meanwhile, current maximum baiju bottling production capacity stands at 90,000 tonnes per year, with 14 bottling lines in operation.

“We have a very solid market position in Henan Province, but we are not satisfied. We want to be known more as a national brand and not just a very powerful, recognizable regional brand,” Mr. Zhou said.

He added that in Dukang’s relentless pursuit of brand recognition, the company was considering the possibility of regular tours to the bottling and fermentation plants for tourists as well as hiring respected celebrities with appropriate gravitas to help promote the company’s products nationwide and beyond.

“These are all real possibilities and we will not leave anything off the table when it comes to helping promote our brand name recognition and status as widely as possible,” Mr. Zhou said.

See also:

DUKANG DISTILLERS: 3 Strong Growth Drivers

DUKANG DISTILLERS: On Track For Full-Year Results Rebound