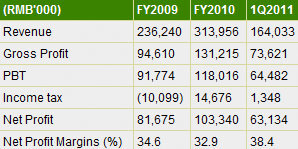

YAMADA GREEN Resources Ltd (SGX: YGR), which listed in Singapore in October of last year, had a standout inaugural first quarter as a public entity, with net profit up 17.5% at 63.1 mln yuan on a top line jump of 31.4%.

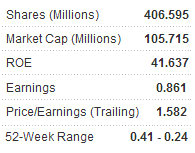

However, Yamada's shares are now hovering near historic lows.

NextInsight recently accompanied 10 Greater China fund managers on an Aries Consulting-organized trip (as part of its Discover the Dragon series which started this month) to meet with Yamada management and find out more about this China-based mushroom producer.

The series of trips brings investors, fund managers and media in close contact with a broad spectrum of PRC-based listcos, allowing in-depth plant tours and revealing Q&As with senior management to help dig out potential gems.

And at first glance, Yamada Green seems poised for robust growth.

January-March revenue of fresh shiitake mushrooms and processed vegetables stood at 164 mln yuan, which is more than half of the 314 mln realized for all of last year.

Yamada enjoys economies of scale, operating one of the largest shiitake mushroom cultivation bases in the eastern Chinese province of Fujian, with a total growing area of 2.9 mln square meters.

It owns eucalyptus plantations stretching over 20 mln square meters which it plans to apply to the government for a logging permit to produce sawdust for synthetic logs destined as substrates for mushroom cultivation.

Yamada is decidedly in the right place at the right time.

The PRC is the world’s largest producer, consumer and exporter of mushrooms, which in the first quarter contributed 78.1% to Yamada’s total revenue, with sales within Mainland China comprising 86% of the company’s total sales.

Yamada General Manager Zhang Yong told NextInsight at the company’s facilities in Fuzhou, PRC that as a newly-listed enterprise, the company was currently more focused on expanding and upgrading its production capacity than any other consideration.

“Our capital outlay is targeted almost exclusively on growth and expansion, both in terms of upstream forestry assets and also mushroom cultivation acreage and downstream processing facilities,” he said.

He said the company saw a fundamental difference between Japan – Yamada’s chief export market for processed food -- and the PRC, its top market overall.

“We consider our growth potential to be strong but limited in Japan. But at this point, I would say our growth potential here in Mainland China is unlimited.”

For this reason, the company always had one ear to the ground to listen for opportunities for expansion or buyouts.

“Sichuan province is a particularly fast area of growth for us, so we are looking to set up a processing facility there. This affords us logistical advantages in terms of market proximity that are crucial in the fresh produce business,” Mr. Zhang said.

And given growing demand in the PRC for edible fungus products like mushrooms, margins reflected on-the-ground market reality.

“Our fresh shiitake mushroom shipments, which make up 95% of our mushroom sales by unit volume, enjoy 50% gross profit margins, while our dried shiitake mushrooms have 40% gross profit margins,” he added.

The company placed a premium importance on research and development.

“Planting, cultivation and processing are all age-old agricultural practices, but the benchmark for cutting edge methodology is constantly evolving. Therefore, we are very big on R&D which we conduct both in-house and via collaboration with nearby universities,” Mr. Zhang said.

He said it made more economic sense to provide funds to nearby agricultural schools where they had the existing R&D and cultivation facilities to develop best practices for mushroom and vegetable cultivation.

“Our R&D activities are primarily targeted at boosting our product range to meet evolving customer demand as well as improving our cultivation and processing technology to enhance cultivation and production efficiency while cutting costs where possible.”

He said that since beginning operations in 1998, the company has grown into a major supplier of self-cultivated edible fungus in Fujian Province, which has both a suitable climate (sufficiently moist) and terrain (shady hillsides and valleys) to support their operations.

“We have adopted an institutional management structure and are therefore able to achieve economies of scale to consistently meet the supply and variety needs of our customers.”

He added that the company’s land-lease arrangement with local farmers provided advantageous seasonal benefits in terms of cost management.

“We lease agricultural land from late September to April from local farmers at favorable rates due to the different growing and harvesting seasons between self-cultivated shiitake mushrooms and other agricultural products.”

This allowed Yamada to minimize labor costs and avoid maintaining a large pool of full-time, year-round employees.

Upstream assets were key to Yamada’s profitability.

“Having our own eucalyptus plantations enables us to manage and control our cultivation costs, ensure timely and reliable supply of synthetic logs and ensure consistency in the quality of our shiitake mushrooms,” Mr. Zhang said.

“Economies of scale are rare in our industry, but we have achieved it.”

He said Yamada was upbeat on continued strong growth in mushroom and vegetable prices in the PRC as Beijing did not intervene to control rises for these commodities.

“We will primarily seek organic growth to meet new demand but we will not dismiss attractive acquisition targets either.”

NextInsight Reader Queries

Here are selected questions we received from our readers:

(Mr. Hui, Zhuhai, PRC): In Yamada's IPO prospectus, they said they plan to distribute more than 20% of profits to shareholders. Do they plan to keep this promise in the future? Does that mean management has a stable and consistent dividend policy?

Yamada GM Mr. Zhang Yong: “Our audited FY2010 bottom line grew roughly 20% as did our unaudited first quarter net profit. Therefore, our dividend payout will reflect this performance going forward. That being said, our firm is very focused on meeting capacity expansion requirements and upgrades whenever and wherever the market requires.”

(Mr. Bruun, The Netherlands): I would much appreciate to learn what you find out when you visit. The stock is absurdly cheap so I have a keen interest in it.

Andrew Vanburen: This one is a bit of a head-scratcher, Mr. Bruun. As one of the largest mushroom operations in the world’s largest edible fungus-consuming market, and with firm positions up and down the planting/cultivation/harvesting/processing chain, its status is hard to reconcile with the abysmally low P/E ratio and recent share performance.

One downside is that its cost of sales (COS) rose 42.7% y-o-y in the first quarter on “increased cost of synthetic logs as well as raw materials for processed food products.”

The firm believes it can boost unit margins even higher if it expands into the distribution business, therefore eliminating the middle man. Management told me that within five years, there is a good possibility that this will become a reality, and the Yamada brand name may be visible on mushroom packets in supermarkets.

See also:

YAMADA CEO: Ex-Tour Guide Who Built Fujian’s Largest Shitake Mushroom Farm

CHINA MINZHONG FOOD, COMTEC SOLAR: What Analysts Now Say...