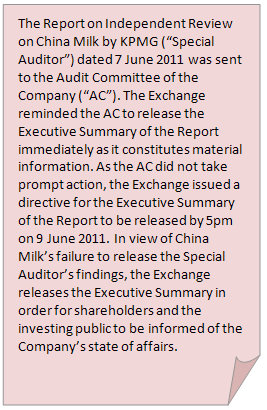

KPMG, the Special Auditor appointed in April 2010 to conduct an independent review on the China Milk Products affairs, has put out its report -- but it was actually published by the Singapore Exchange this evening after the audit committee of China Milk failed to post it despite reminders.

It’s a damning report, and after reading it any reader can only conclude that the China Milk management - including Chairman Liu Shuqing, 61, and his son, CEO Liu Hailong, 41 - had done a grave injustice to minority shareholders.

Trading in the shares of the company, which produces pedigree bull semen, pedigree dairy cow embryos and raw milk, has been suspended since Feb 2010.

This was a company that once commanded a market capitalisation of S$1 billion and, since its listing in 2006, had wow-ed a lot of investors with its supposedly immense profit margin, its profitability and cash hoard.

The hard truth started to emerge when China Milk's convertible bond holders decided to redeem their bonds.

The company at first claimed it had the US$170.56 million to meet its obligations on the convertible bonds. It just needed time and special approval of the authorities to remit the money out of the country.

After all, it had said in its financial results announcement that as at end-September 2009, the group’s cash and cash equivalents stood at 2 billion yuan (S$409.7 million).

As matters worsened, the Singapore Exchange directed the company to appoint a Special Auditor.

KPMG was the chosen one and it found a company whose cash hoard had been milked in major ways.

When it repeatedly asked the Group to arrange an interview with its bank manager in China, KPMG was told that the manager had no time and could not assist.

When KPMG asked to interview the main contractor which did US$72.9 million worth of improvement works, they were presented with a Mr Zhang Hong Tao who came across as being unfamiliar with the works done.

In the first place, he didn’t own a construction company.

The Group had commissioned improvement works to the farm and facilities and paid USD72.9 million over a period of 5 – 6 months ending in or around March 2010.

When KPMG visited the sites, it was unconvinced.

“One would expect salubrious farming facilities after spending USD72.9 million. However, the buildings and its facilities cannot be said by any stretch of reason to be no more than basic or at best average.”

In addition, KPMG noted that the Board approval for the expenditure on the improvement works was not obtained nor has KPMG seen any Board minutes whereby the Board was informed of the expenditure.

In another major expenditure, China Milk announced on 4 December 2009 that the Group “entered into the final stages of completing the acquisition” of 40% of a joint venture company for approximately USD20.6 million.

It also said it had “earmarked” USD29.4 million to expand its farms and facilities and “secured” grassland and agricultural land for approximately USD20.6 million.

KPMG: “However, the Group had in fact spent substantially more. We have not seen any evidence indicating that the Board contemplated and approved the announcement nor discussed or questioned the merits of the investments therein during the material time right after the announcement was made.”

It added: “To date the Group has been unable to deliver to us any meaningful documents to evidence the completion of the acquisition. Instead, we are told that the acquisition is not complete pending fulfilment of certain conditions precedent, the particulars to which were not identified to us. It therefore stands to reason that since the acquisition has not completed, the shares have not been issued to the Group.”

There are many more damning findings in the KPMG report, which you can read on the SGX website.