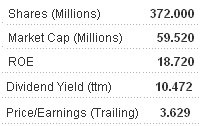

WILLAS-ARRAY Electronics Holdings has just proposed to pay a final dividend of 1.65 Singapore cents a share for FY11 (ended March), translating into a yield of 10% based on the recent stock price of 16.5 cents.

The payout, while generous, drew some comments in our forum.

In particular, the discussion centred on whether it made sense for the company, which is a distributor of electronics components mainly in China and Hong Kong, to have a rights issue in April and subsequently propose the dividend.

A reader, marcus168, wrote in this forum thread: “Right Issue they raised about $7.5 million. Estimate cost for right issue 1 to 1.5 millions? Estimated raised $6 millions. Dividend Payout about $6 millions.

“Basically shareholder forked out 7.5 millions and give get back $6 million within 3 months. And wasted 1.5 mllions for doing extra work that worth nothing.”

An opportunity for us to clarify this matter came up yesterday at CIMB where Willas-Array’s management, who had flown in from Hong Kong, was making a presentation to investors.

To a question, Willas-Array’s executive director and CFO, Andy Hung, said the company would have proposed the same final dividend even if it had not carried out a rights issue.

Q: Why the rights issue then?

“We need to expand further in China and need more working capital. It’s not that we cannot get by without it. We can get by but we don’t want to raise our gearing ratio – so that’s why we got more cash in,” said Mr Hung.

He added that the size of the fund-raising of $7.2 million was relatively small, “because we were worried that some shareholders wouldn’t like it. Well, we are paying it back to them through the proposed dividend.”

Q: What was the cost of the fund-raising?

Mr Hung: “We didn’t use any merchant bank – we used a legal firm that cost us S$150,000-200,000. The cost was quite minimal.”

As background, as at March 31, 2011, Willas-Array had working capital of HK$360.0 million, which included a cash balance of HK$417.1 million, compared to a working capital of HK$319.7 million, which included a cash balance of HK$410.1 million at March 31, 2010.

On May 26, Willas-Array reported that its FY2011 (ended March) saw its net profit rise 22.0% to HK$86.0 million.

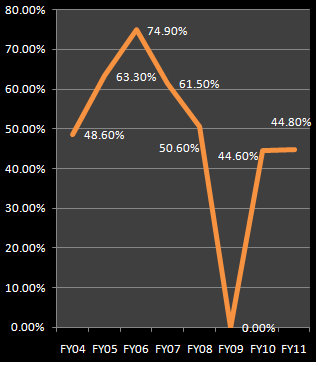

Q: Going forward, will the dividend payout stay at the current level of about 40% of net earnings?

Mr Hung: “We don’t have a fixed dividend policy. We will try to maintain a good dividend when there is good profit.

"In the past two years, it so happens that we were able to pay about 40%.

"It will depend on the size of the profit, the need for working capital, etc. If our profit stays around the same size, probably we will do about 40%.”

Read about a peer: SERIAL: Steady profit growth in 1Q, closer to acquiring JEL

Our story last year: WILLAS-ARRAY: Rides electronics boom, reports record HK$71 m profit