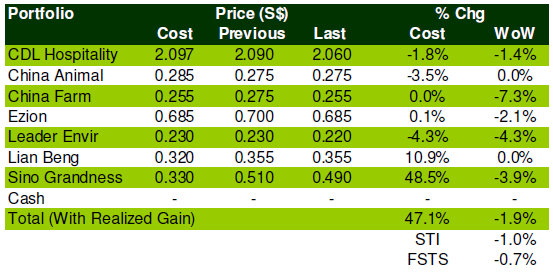

The table below shows the week-on-week change of Terence Wong's portfolio.

He had started a hypothetical portfolio with $1 million in July 2010 (read: TERENCE WONG: 'What I would buy with $1 m') and it has since gained 47.1%

My model portfolio experienced an uninspiring week (May 23-27), falling 1.9%.

Stocks were either flat or in negative territory as small caps took a thumping with bad news from the Eurozone.

With the global economy seemingly fizzling, small caps typically bear the brunt. China Farm Equipment and newly-included Leader Environmental were the biggest casualties last week, slumping by 7.3% and 4.3% respectively.

I will still be sticking to my portfolio, which I believe will outperform when the market turns. So far this year, the portfolio is up a respectable 15.4%, versus declines of 1.7% for the STI and 12% for FSTS.

Recent stories:

TERENCE WONG: How my stock picks have done

LIAN BENG: S$119 m cash hoard, stock is 4X PE

SUPER, STAMFORD TYRES, SINO GRANDNESS: What analysts now say....