Glenn Ho, formerly an investment banking analyst, and Jay Ng (above), previously a trader with Deutsche Asset Management. Photo by Sim Kih

Glenn Ho, formerly an investment banking analyst, and Jay Ng (above), previously a trader with Deutsche Asset Management. Photo by Sim Kih

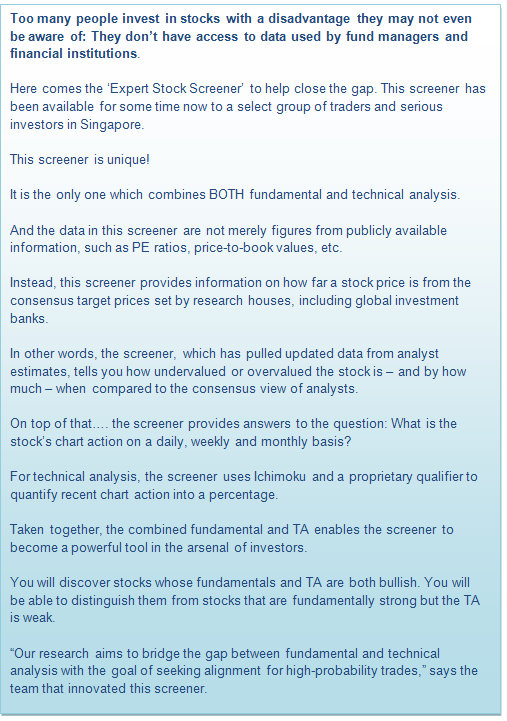

# Apr 2 post: Last weekend's post decribed Epicentre as a successful short-term play using one method of screening, which involved ‘alignment’ of TA and FA criteria.

Now, learn how an investor who is more fundamental in nature gained 16% in just 2 weeks!

Using the 18 March 2011 Expert Stock Screener, he sorted SGX stocks based on just 1 criterion: Display the most undervalued stocks to the least undervalued. (The data comprise collective estimates from research houses and investment banks and are built into the Screener).

Eratat Lifestyle topped the table as it was a whopping 153% away from the consensus analyst target price (see screenshot below), with a closing price of $0.19. Two weeks later, Friday 1 April, Eratat closed at $0.22, a 15.8% increase!

# Mar 26 post: Learn how one SGX trader made 29% in one week. Using the 18 March 2011 ‘Expert Stock Screener’, he screened SGX stocks for the following criteria:

1) Bullish alignment between Fundamental and Technical Analysis

2) Fundamental: Stock is undervalued by >20% (Based on Analyst Consensus)

3) Technical: Daily/Weekly/Monthly charts display >50% Bullishness

Based on this, only Epicentre Holdings surfaced (as seen in the screenshot below), with a closing price of $0.51. As of 25 March (last Friday), Epicentre’s share price has risen to $0.66!

1) A video giving insights on how the screener works can be viewed here.

Another video on how some traders might use the screener is here.

2) For a free trial, register by sending an email to

3) To subscribe, click here now.

The people behind this:

*** Glenn Ho, formerly an investment banking analyst with New York-based Jefferies & Company, which handles capital raising and M&A activity in Southeast Asia.

*** Jay Ng, previously a trader with Deutsche Asset Management, Deutsche Bank AG dealing with global equities, fixed income and FX. He also served as Vice President (Trading) with Moon Capital, a market-neutral hedge fund.