DMX Technologies is in the sort of business that gets abstract looks from investors usually, except those who are savvy about IT.

But there are reasons for anyone to attempt to understand it and put it on one’s radar screen. One of these reasons would be its boldly announced forecast of the growth rate for its revenue.

It’s 20% compounded annually over the next five years – which means the US$271 million achieved last year would grow to hit US$674 million.

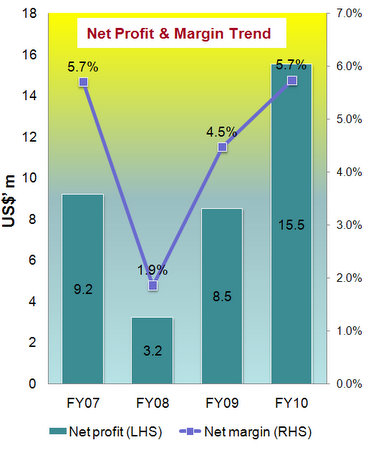

DMX does not give a forecast for its profit growth – but if we assume 20% CAGR, the figure rises from US$15.5 million last year to US$38.6 million five years down the road.

This assumes that the net profit margin is unchanged from last year’s.

On an earnings per share basis, the stock would be trading at around 7.8X PE (assuming the recently traded price of 33.5 cents), down from the current 19.4X PE.

What if DMX’s net margin continued its rise, as it did from 1.9% to 5.75% between 2008 and 2010?

Chances are the margin will indeed expand as DMX emphasises more on its Digital Media business (as opposed to its Infrastructure Enabling division).

China: IT, mobile, cable growth

DMX's turbocharged growth - net profit was up 82.9% last year to US$15.5 million - is being made possible chiefly by the growth of the market in China.

In 2010, DMX derived 77% of its revenue from China, with revenue crossing US$200 million for the first time in its history.

Various massive upgrading projects are happening there, mainly:

a) A switch from analog to digital content delivery for TV content, as mandated by the PRC government.

b) The mobile Internet market is being propelled forward at a CAGR of 78% until 2014, according to forecasts cited by DMX.

Securing a booster recently, DMX announced that, after a year of trying, it finally had been granted a licence from the Chinese Ministry of Industry and Information Technology to provide Value-Added Services (VAS) to mobile operators throughout China.

DMX expects to launch its VAS for enterprises and consumers by the end of 2Q this year.

Revenue from VAS will go to its Digital Media division, which contributed US$101.2 million, or 37%, of DMX’s revenue in 2010.

It was up 46% year-on-year – as we said, it’s a strongly growing market.

DMX's other business division - Infrastructure Enabling - has been its traditional core business of integrating hardware for telecom operators and enterprises.

Here, essentially, DMX sources for various types of hardware, integrates them and offers security services around the hardware, especially to SMEs.

This business segment is buoyed by rising IT expenditure, and contributed US$169.4 million in revenue, or 63% of total revenue, last year.

Overall, as at end-2010, DMX had an order book of US$61.8 million, up 31% year on year, and it would be realised in 1Q this year.

DMX has not proposed a dividend for 2010 - and doesn't look it would for the forseeable future.

This has largely to do with the fact that its majority (51%) shareholder, KDDI, had injected capital of S$183 million in late 2009 to acquire its stake - and it would not make sense to return some of the cash to KDDI, the second largest telco in Japan, via a dividend since it is not in need of such cash. Instead, DMX considers it more sensible for it to use the capital to grow its business strongly by leveraging on KDDI's products and services.

New Media Services

This is the name for a new segment within the Digital Media division. New Media Services is lucrative: DMX envisions itself providing localized content and application services for the interactive TV and 3G smart phone markets with its VAS licence.

An example of a VAS offering from DMX is mobile Points of Sale in retail stores.

The revenue is recurring and based on usage by the consumers.

In 2010, this New Media Services brought in maiden revenue of US$946,000 with the deployment of local content services to a telecom operator and a cable TV operator.

In another area, DMX is upbeat about Fixed, Mobile and Broadcasting Convergence (FMBC). The PRC Government has mandated the set up of pilot FMBC programmes in 12 cities over the next two years, requiring multi-million dollar capital investments by each operator.

DMX envisions leveraging on its shareholder, KDDI, for technology and expertise to compete for FMBC business.

Recent story: DMX TECHNOLOGIES: Record 3Q revenue, another record in 4Q?