Easily recognizeable green packaging of GP Batteries

However, the same person will almost certainly recognize one of the group’s flagship products – the familiar green and yellow GP batteries, both in recyclable and throwaway varieties.

First, it should be explained that the company has a somewhat complex shareholding structure.

Hong Kong-listed parent firm Gold Peak Industries (Holdings) Ltd owns 69.3% of Singapore-listed GP Industries Ltd (SGX: GP Ind), which in turn has two divisions: Electronics and Batteries.

The latter, which is 49.2% held by GP Industries Ltd, is also listed in Singapore as GP Batteries International Ltd (SGX: GP Bat).

In May 2009, Gold Peak Group entered into agreements to dispose of its 49.1% interest in superscreen maker Lighthouse to Linkz Industries Ltd, a 47% owned associated company of GP Industries. The transaction was completed in October 2009.

Mr. Barry Ho, financial controller of Gold Peak Industries (Holdings) Ltd (HK: 40), recently met with NextInsight, Aries Consulting and a group of Greater China fund managers to explain the firm’s strategy going forward.

He said that one way to fight margin erosion in a recession was to cut costs, and that was a key part of the firm’s recent success.

“We can’t be entirely recession-proof, but we can adjust product mix and output to respond. We still have a lot of price competitiveness versus smaller competitors and have been implementing cost cutting measures as well as enjoying lower material and interest costs,” Mr. Ho said.

L-R: Barry Ho, Financial Controller, and Wong Man Kit, General Manager of Finance. Photo by Terence Wong

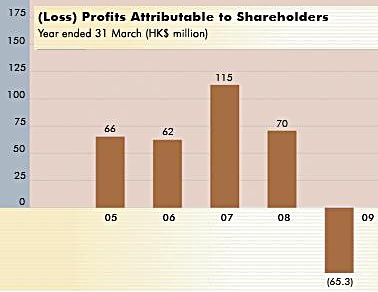

GP Batteries is an associated company of Gold Peak Group and its revenue is not consolidated. GP Batteries’ turnover for the year ended March 2009 was 4.7 bln hkd, down 9% from the previous year.

“Group revenue will be down around 10% this fiscal year, with the global downturn mainly affecting battery and electronics businesses. But we still expect to see a profit this (fiscal) year,” he said.

He said its 69.3%-held Singapore-listed unit, GP Industries, enjoyed some flexibility as it was not fully exposed to manufacturing alone.

“GP Industries Ltd is a manufacturer and is also an investment company. And we are in a ‘leverage stage’ at this point. We are trying to improve our balance sheets during a time when it is quite difficult to borrow from banks. Lenders in Hong Kong and Singapore are quite conservative. Therefore we are still looking to seek organic growth.”

He said that having three separately-listed entities under the same group umbrella is something the company may consider altering as it continues to trim gristle and fatten margins.

“We are now three listed companies, which may or may not be the best way to run a business. So we have been asking advisers to see if there is a simpler way to streamline the structure in medium term.”

Although GP is one of the top 10 battery makers in the world, he said the global consumer industry was mainly dominated by foreign names like Duracell, Energizer, Eveready, Sanyo and the like.

Source: www.goldpeak.com

But this did not stop Hong Kong-based Gold Peak from linking up with these erstwhile competitors when it suited them.

“No battery producer is able to produce a full range of batteries so sometimes our competitors are our suppliers. It’s an interesting relationship. In fact, we get a lot of OEM export orders from Duracell and Energizer. For our GP batteries, we are mainly selling and promoting in Greater China and Europe to promote our brand.”

“In the mid-90s, we began shifting somewhat away from OEM manufacturing to begin a brand building campaign for GP batteries.”

Even a cursory glance through GP Batteries International’s catalogue drives home his point about product diversity… and complexity.

Its revenue is 45.5% reliant on rechargeable batteries, 43.0% on primary cylindrical disposables, and 11.5% primary specialty disposables.

These can further be broken down into a wide range of applications -- from your garden variety AA, AAA, C, and D-cell batteries found in every home, to rechargeable batteries that power electric bicycles, golf carts and even some automobiles.

However, GP was not putting the pedal to the metal on racing forward with rechargeable car batteries.

“We do work with some US/EU firms on the auto side, but we don’t want to go large scale because it would narrow our business focus. We are still a relatively small company, with not a lot of money for R&D.”

|

|||||||||||||||||

One metal that concerned the group immensely was nickel (Ni), as it comprised a significant portion of material costs.

“Cost of materials are very important to us. Batteries are rather capital intensive because of the chemical systems involved. Nickel prices can be quite unstable, mainly due to speculation, but our six-month maximum hedging practices help control prices and helps us maintain good relationships with suppliers,” he said.

For the company’s electronics operations, which served the professional sound system and LED large screen market primarily, as well as computer and sound equipment cables, he said Gold Peak did not put all its eggs in one basket.

“Our electronics business is also quite global. We don’t over-rely on a single country or market. Actually, Asia and the EU are more important to us for both electronics and batteries than the US. And we are always launching new products in these markets.”