HUNG HING Printing Group Ltd, one of the largest printers and consumer product packagers in Asia, has been providing the boxes for brand name toys, personal care items, popular beverages and a wide range of products for over half a century.

The Hong Kong-based firm, with four factories in the mainland and one in the HKSAR, counts among its clients some of the most recognized names in toys and consumer goods, as well as leading publishers from around the world.

And although Guangdong province -- where three of its four PRC plants are based – has been hit by the downturn in external demand, the company believes that its wide product / service capability and the various initiatives that the management has taken will help to maintain its margin and minimize impact to its bottom line.

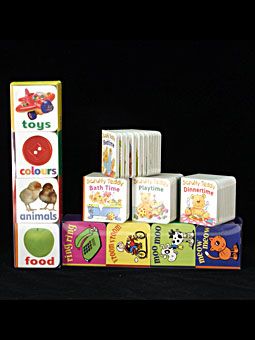

“We’ve been in the children’s book making business for decades, focusing on export. We have a long client list including many of the leading players in the publishing business."

“Yes, the global recession hit us, and hardest on our paper manufacturing operation. But we found that books, especially children’s books, are less impacted by the economic downturn,” said Mr. Eric Lui, Hung Hing’s Vice President for Finance.

In a meeting last week in his Hong Kong office, Mr. Lui -- who has been with the company for a year but already has mastered the fundamentals of the trade – told NextInsight and Aries Consulting that Hung Hing knew precisely when and how to adjust its product portfolio to maximize profitability for shareholders.

“We used to be more heavily exposed to papermaking, but we realize it’s a capital intensive industry and economy of scale matters. And Hung Hing does not have the competitive edge in this business. We prefer to focus on what we are good at - printing and packaging.”

He also dismissed any short-term challenge from the Internet and electronic media, which have devastated traditional broadsheet newspapers and periodicals, with even stalwarts like the New York Times flirting with bankruptcy.

“Near to mid-term, I see no impact to our children’s book business from the Internet or DVD ‘books’. While newspapers and magazines will be hit even harder over time, you have to remember that it is really hard to read bedtime stories to your child from a computer or DVD player,” Mr. Lui said.

Readership numbers for many print media have suffered significantly as more and more people sate their daily news fix online.

“Children’s books are actually still very labor intensive. Each book is very different, so it’s hard to have a high degree of automation,” he said. “Books, children’s books and packaging printing are our core businesses.”

Parents always buy toys for their kids, whether as birthday gifts or for the holidays. On the other hand, the toys and the packaging and boxes that Hung Hing makes to house them before they are ripped to shreds under Christmas trees would still need time to recover to pre-recession levels.

“Hung Hing is big in the providing of packaging services to toy manufacturers. Among our toy clients are well-known brands and we make attractive packaging for the popular characters that are created by the latest Hollywood blockbusters.

“The packaging side of our business has a good mix between export-oriented and domestic market. Our sales volume is closely linked to the activity level of our manufacturing customers in the Pearl River Delta. Whenever there is a growth in income, then we will benefit,” he said.

He said Hung Hing was hopeful that China’s 4.5 trillion yuan stimulus package, prescribed to lessen the country’s dangerous overreliance on exports by giving a shot in the arm to domestic consumption, would bring a flood of orders for consumer goods packaging.

“We want to expand our presence in the domestic packaging industry, especially in the South and in the East via our Zhongshan and Wuxi plants. Beyond organic growth, we’ll also be interested to look into suitable acquisition opportunities to fast track our entry into new market segments.”

When asked if the spate of factory closures in Guangdong province were translating into the ability to cut costs on lower wage inflation, he said that was the case in southern China, but only to a limited extent.

“On the other hand, there is still rising wage pressure in Zhongshan and Wuxi where recession, if any, is less apparent.”

Not just child’s play

Hung Hing also makes packaging for grown-up toys.

“We also produce corrugated boxes for printers, computers and other peripherals for a number of international and domestic brands,” he said.

‘We are also doing well in the providing of packaging services to the domestic food and beverage manufacturers. This covers herbal tea drink, biscuits, confectionery, cooking oil and soy sauces. We see high-growth opportunity in the Personal Care segment. With rising incomes, people are buying their daily groceries from super-markets which will boost the need for quality packaging,” Mr. Lui said.

Hung Hing has been gradually reducing its exposure to paper manufacturing.

“Reduced demand, over-capacity in the Delta and volatility in waste paper costs significantly impacted our business in FY 09. In response, we have temporarily scaled down our production volume and we are reducing our equity stake in this business. This will help to minimize the volatility and its impact to the Hung Hung group P/L and to allow the management to re-focus on its core business - printing and packaging.”

In the financial year-to-March 2009, paper manufacturing incurred operating loss of HK$142 mln. Additionally, an impairment charge of HK$288 mln was made, reducing the carrying cost of the paper mill down to HK$64 mln.

Hung Hing believed it fortunes going forward would best be linked to the paper and carton box printing, a category which contributed 48% of total group revenue over the past 12 months period ended March 2009.

Among this, 49% was for the printing of books (including children’s books), 25% was for the toy market and the remaining 26% for packaging a variety of consumer goods.

Mr. Lui said the the group’s year-to-March 2009 revenue was down by 5.4% mainly due to the shortfall in the paper manufacturing business.

“Financially, we are still very strong. We have the cash capacity to continue to pay dividends,” he said.