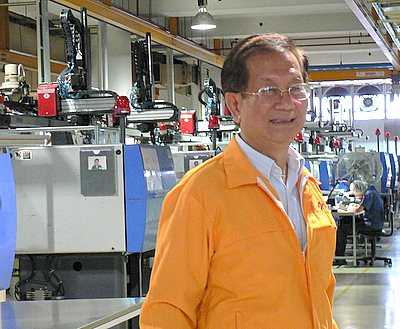

Mr Yao in his factory in Jurong. Photo by Leong Chan TeikTHERE ARE few Singaporeans like Mr Yao Hsiao Tung who can be the poster hero for a number of causes. At 69, instead of being long retired and doleful about life, he is working at full throttle and loving every minute of it. Any Singapore campaign to encourage people to work past 62 should feature him.

Mr Yao in his factory in Jurong. Photo by Leong Chan TeikTHERE ARE few Singaporeans like Mr Yao Hsiao Tung who can be the poster hero for a number of causes. At 69, instead of being long retired and doleful about life, he is working at full throttle and loving every minute of it. Any Singapore campaign to encourage people to work past 62 should feature him. Mr Yao is the executive chairman of Hi-P International, someone whom success gurus also will want to highlight as a case study in the triumph of the fighting spirit. Hi-P now employs more than 15,000 people when it once had only six.

He can also be an inspiration to Singaporeans who have automatically turned to careers in multi-national corporations and the civil service. As Mr Yao’s case demonstrates, it’s never too late to be an entrepreneur. Mr Yao became one at 43.

Despite all that, his story is little known. With business operations in five countries, he has spent much of his time abroad. But because his company is public-listed, he recently made an appearance – and a rare one at that - before analysts and journalists in Singapore to discuss its performance. I caught a whiff of his life story and asked to meet him.

At his office in the International Business Park in Jurong East, I was initially struck by his seeming indifference to his appearance. He wore a yellow jacket with the company name smartly stitched on, which did not distinguish him from the rest of his staff who wore the same yellow jacket too. He didn’t put on a tie. His trousers seemed over-sized.

His office is anything but opulent. There is no expensive painting, no exquisite antique, no luxurious carpeting. I recalled the case of the recently-ousted Merrill Lynch CEO John Thain, who spent extravagant money on renovating his office, including US$1,200 on a waste-paper basket, when his company was in financial distress.

He would have found Mr Yao’s office depressing to work in. But not Mr Yao, for whom the office is where he comes alive. “I enjoy work. I really enjoy work. That’s why I seldom relax,” he says. “You won’t believe it but people say that I have a lot of energy for someone of my age.”

He would have found Mr Yao’s office depressing to work in. But not Mr Yao, for whom the office is where he comes alive. “I enjoy work. I really enjoy work. That’s why I seldom relax,” he says. “You won’t believe it but people say that I have a lot of energy for someone of my age.” “In the last six weeks, I worked even on Saturdays and Sundays, as we conducted training for top management in China and Singapore, and other Hi-P sites via computer,” he says, adding that he had developed some of the training programmes and conducted them.

As if being 69 and working hard are not enough to make him an oddity among people of his age group, he reckons that he has many more working years ahead. The reason: “I think I have good genes. My father is 94 and still reasonably healthy. My mother is 89 and pretty healthy. I sleep well, I don’t overeat, and I drink only a little socially.”

Mr Yao once took up golf briefly but gave it up because he didn’t have the luxury of time for the game. Instead, he swims at Jurong Country Club and takes walks after work and on weekends in the Botanic Gardens, which is near the bungalow where he lives with his wife, Madam Wong Huey Fang, an executive director of Hi-P and its chief administrative officer. The couple does not have children.

On the issue of retirement and succession planning, he says: “When the appropriate time comes, I will not be in the frontline; I will take a back seat in the company.” He declined to be specific about a timeline but he certainly had no plan to give up work totally anytime soon. For now, he is in the thick of things, as he leads his company through the current economic recession.

There are probably a few other things that explain why Mr Yao is still a go-getter. He is its largest shareholder, owning a little more than half of the company. His stake had a market value of about $200 million based on a recent stock price of 41 cents.

And while he did not found Hi-P, he was the one who resurrected it from the ashes – and he did so after several painful years and much financial loss.

A good 26 years ago, Mr Yao took over Hi-P, then a three-year-old mould-making firm, by investing his savings of $50,000. It was loss-making and had six staff. It kept bleeding for another four years until Singapore emerged in 1987 from a recession.

From a single business operation in Singapore, the company has since grown to one with manufacturing sites in five countries – Singapore, Thailand, China, Poland and Mexico.

Producing Blackberry smartphones

Hi-P has become a vertically-integrated turnkey contract manufacturer in the telecommunications, consumer electronics, data storage, medical and automotive industries.

Big-name clients include Research in Motion, which produces Blackberry smartphones, and Procter & Gamble, a Fortune 500 multi-national which manufactures a wide range of consumer products.

What Hi-P does: product design, tool design and fabrication, mass production, assembly and supply chain management.

In 2005, Hi-P achieved record revenue ($633 million) and profit ($89 million). This was followed by another record year last year, despite a fourth quarter where revenue and profit were affected by the global economic crisis.

Overall, last year’s revenue breached the $1-billion barrier to reach $1.1 billion, making it the best year in the company’s history. Net profit followed the same trajectory to reach $102 million.

Net cash generated from operations surged by a whopping 151 per cent to S$164.8 million. At the end of 2008, Hi-P had a strong balance sheet with net cash of S$125.9 million and a mere 1.0 per cent gross gearing.

While the company’s profit margins and cashflows were pleasant surprises to Nomura Singapore analyst Chitra Gopal, she has a ‘neutral’ call on Hi-P stock because of the company's dependence on a few key customers. By her estimate, Research in Motion accounted for about 50 per cent of the fourth-quarter sales of Hi-P.

She also voiced concerns over the broader smartphone industry, which “cannot escape falling margins this year.”

Hi-P’s peers recently traded at an average FY08 Price/Book value of 0.62. Using Hi-P’s FY08 book value of 51 cents, Ms Gopal derived a price target of 32 cents for the stock.

DVS Vickers analyst Sachin Mittal has a more positive view on the stock. He recommended a ‘buy’ on it and a target price of 55 cents based on 0.8X its forecast book value this year.

He added that the fourth-quarter of last year delivered an excellent set of financial figures which, together with the impressive second and third quarter results, should reinforce investor confidence in Hi-P. The company’s outlook this year, while challenging, is still better than the overall industry’s, due to the stable wireless segment, said Mr Mittal.

A little higher than Mr Mittal’s target price is that of Credit Suisse analyst Lim Keng Hock, who has a target price of 59 cents. Mr Lim wrote: “The outlook is challenging but we believe new orders from RIM, Apple and HTC will help Hi-P to outperform its peers. The current share price offers very good value but the constraint for now is its low liquidity and a lack of appetite for small-caps.”

Given the way Hi-P stock has performed, Mr Yao seems to have a bone or two to pick with the market. He noted that in 2005, when Hi-P achieved revenue of $633 million and net profit of $89 million, the stock closed at $1.69 at the end of the year.

But recently, soon after Hi-P reported $1.1 billion in revenue and $102 million in net profit for 2008, the stock price hovered around 30-something cents only. By late March, the stock had moved up to 44 cents, propelled by the company’s enthusiastic share buyback amounting to over 13 million shares at the point of writing.

Certainly, Mr Yao is pleased to see his share price rising following the sterling business performance last year but it was with a sober tone that Mr Yao spoke with journalists and analysts at Fullerton Hotel recently about the company’s 2008 results and the business outlook.

Mr Yao, who is anyway a serious man most of the time, noted that in the fourth quarter of last year, the company’s profit slipped when compared with the third quarter of last year and when compared with the fourth quarter of 2007.

He acknowledged the challenges that lay ahead, which sounded all too familiar to everyone present – order slowdown, increased competition, potential financial difficulties faced by customers and suppliers.

My ears perked up when I heard the words ‘fighting spirit’. Now, that sounded different.

“We will intensify our team fighting spirit,” said Mr Yao. “At the end of last year and the beginning of this year, I traveled to attend the annual D&Ds (dinner & dance) at all the Hi-P sites. I communicated to my key staff the situation we are facing and the measures we will take.

“They have a fighting spirit, and I told them to cherish whatever business we have in hand, and we should put in tremendous effort to fight for new business.”

He concluded: “We are determined to fight through the recession. After the recession is over, I believe Hi-P will reach a new height.”

Asked how Hi-P was doing so far in the new year, Mr Yao said revenue was expected to be lower in the first quarter compared to the same quarter last year.

"However, the Group aims to maintain similar profitability through better cost control," he said. Now, that's some fighting spirit - and if the same profitability is indeed achieved, we are talking of $25 million.

I asked him about his fighting spirit during our subsequent interview at his office. “My fighting spirit comes from my life experiences, especially during my childhood in Taiwan. I suffered tremendously. Our living standard was very low as my father would lose his job and keep on changing jobs. We moved home a lot too.”

Etched in his memory are the times when he walked barefoot to school in winter. Faced with biting cold wind, he and his classmates would take shelter among the ruins of buildings destroyed during World War II.

“We didn’t have enough clothing, didn’t have enough food. We would collect fallen branches of trees for a fire to cook. Whenever my mother fell sick, I had to look after my younger sister and two brothers.”

Those experiences moulded his fighting spirit. “A tough life can polish you, and you develop a fighting spirit. I have benefited from it.”

Starting from being a technician, he rose to become a supervisor in Du Pont in Taiwan. The multinational subsequently posted him to its Singapore office as a technical service manager in 1979.

Four years later, Mr Yao invested in Hi-P, a move that he must have some regrets initially. “For the next three to four years, the business continued to lose money. We had only $90,000 left in the company and $130,000 of bad debt. I couldn’t sleep at night. After three or four hours, I would wake up. I went out to take a walk for one or two hours, then shower and go to work.”

Mr Yao was born in China, raised in Taiwan and now lives and works in Singapore, and is a Singapore citizen. Photo by Leong Chan TeikIn 1987, Hi-P achieved a breakthrough when it formed a joint venture with US multinational Molex to supply the company with electronic connectors.

Mr Yao was born in China, raised in Taiwan and now lives and works in Singapore, and is a Singapore citizen. Photo by Leong Chan TeikIn 1987, Hi-P achieved a breakthrough when it formed a joint venture with US multinational Molex to supply the company with electronic connectors. Soon, Hi-P secured another major client, a leading US hard disk drive maker which is still a major customer today.

By 1993, China was opening its doors to foreign investment and Hi-P was among the first companies from Singapore to set up a manufacturing facility there. Mr Yao, by then a Singapore citizen, recognized early the cost advantages offered by China, as he had been tracking the country’s development closely. China has a dear place in his heart, as it was his birthplace.

Mr Yao set up his first Hi-P plant in Shanghai. Over the years, several more Hi-P plants would spring up in various parts of China such as Qingdao and Xiamen, making the company’s presence in China one of the most extensive among Singapore-listed companies.

Just when Hi-P’s sales and profits were growing strongly, a crisis shook Mr Yao. In 2000, his general manager in Shanghai not only quit but also took away more than 50 top management and skilled workers to another company.

The crisis called on his fighting spirit. “My staff felt insecure. They thought that the company would close down. I talked to every section head, let him know what happened and that I have a fighting spirit. Our financials were strong. They trusted me. After that, I gathered all their subordinates and spoke with them group by group. In just one year, we had turned around the situation. You can see from this example that the fighting spirit is most important.”

Hi-P not only regained its momentum but headed higher by achieving a listing on the Singapore Exchange in 2003. Mr Yao was 63 years old then. The year before, Hi-P had achieved revenue of $143 million and net profit of $17.9 million.

As Hi-P captured more business, the values it fostered in the company set it apart in many ways from other employers. In its training programmes, the staff, including top management, are subject to tests to ascertain if they had learnt what was imparted. If they fail, they have to go for the same training and tests again.

That’s a form of discipline. “In the manufacturing industry, the discipline has to be like in the army,” says Mr Yao.

He adds: “When they submit reports, whether in writing or verbally, we want our people to tell the truth. Then top management won’t get false information and set the wrong strategy. This is very important.”

A sense of austerity runs through the company. Mr Yao doesn’t believe too much in entertaining. Certainly, he won’t go to karaoke sessions with business partners but a dinner and a glass of red wine is fine.

Even then don’t expect too much of that, though, as he seems to suggest. “We believe hard work, delivering good quality products, good services, and competitive prices – that’s what customers need. If you can give them satisfaction in this respect, and maintain good relationships – I believe that’s enough.”

His management style: “We are purpose-oriented. We choose a set of KPI (key performance indicators) for each individual. We collect data to measure his performance and we reward accordingly.”

It may seem like a tough workplace, but Mr Yao can be the poster hero for learning and discipline. He says he has faced various handicaps on the job but overcame them all. “I learnt by myself a lot of things. Now I have mastered various areas – finance, HR, and logistics.”

His ambition for Hi-P continues to grow. “About 20 years ago, I dreamt of achieving $100 million in revenue. If people knew, they would have laughed at me. Last year, we achieved more than $1 billion. I hope now people believe my goal is for Hi-P to achieve multi-billion dollar sales. I am an old man who is still very ambitious.”

This article was recently published in Pulses magazine and is reproduced here with permission.