CHANCE FAVOURS the prepared mind – this saying is apt about the 25 NextInsight readers who visited Koon Holdings yesterday (Dec 11) well-prepared with questions and background information.

They were duly rewarded with lots of insights into Koon's business outlook and, generally speaking, the construction industry.

Their stream of questions during the Q&A session and over lunch impressed the management.

Mr Bhvvanesvaran Muthu (aka Bonis), a senior manager at a Koon subsidiary, told me: “I’ve done presentations for various groups of visitors – I’ve not come across some of the good questions which this bunch has raised. I’m surprised they know the industry so well.”

Some of the readers engaged Koon Holdings CEO and MD, Mr Tan Thiam Hee, in a wide-ranging discussion during lunch and didn’t leave until 1 pm.

The event, organized by NextInsight, started at 10 am at Kranji Way where Koon owns a pre-cast subsidiary which it bought a 75% stake in in March this year.

Koon, one of Singapore’s largest civil engineering, reclamation and shore protection specialists, later bought another precast facility in Bt Batok in August.

For an idea of the insights that the readers were rewarded with, consider that, responding to a question, Mr Tan said the utilization rate of its precast facilities stands at about 20% currently.

This is a low number since, as we learnt, the other precasters in Singapore are operating at near full-capacity.

While on the surface this looked like disappointing performace by Koon and raised doubts about its ability to win jobs, we learnt that the previous owners of the pre-cast facilities were unwilling to develop the business as they intended to sell out in order to switch to other businesses.

So while a search for buyers was ongoing, the pre-cast facilities did not have the financial support and the hunger to chase for new business.

$34-m orderbook for pre-cast - much more to come?

This situation has completely changed with Koon showing up as the new owner – so, from almost nothing, it now has an orderbook of S$34 million of precast work.

Most importantly, it has tendered for a lot of contracts which, perhaps, other precasters may not bid aggressively for since their hands are full.

It then follows that Koon's pre-cast facilities - which are among the biggest in Singapore - could contribute substantially more revenue next year as the industry rides on a boom in the construction of HDB flats.

That may help to explain why knowledgeable investors have driven Koon shares up some 75% since July this year, as they saw a bright future for Koon following its acquisition of the pre-casters.

As a matter of fact, the pre-cast orderbook has soared from $8.8 million as at end-June to S$34 million now.

Pre-cast contributed 8% of revenue in 1H2010. Other revenue contributors were construction (75%), land-based rental (11%) and marine logistics (6%).

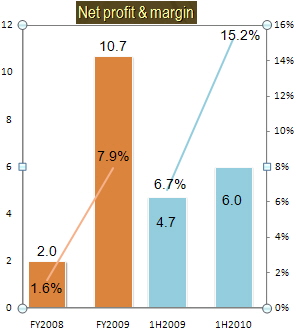

While the construction industry typically has thin profit margins, Koon shares could enjoy further upside as Kim Eng Research, in a report last month, said Koon is undervalued relative to its peers, has a significant cashpile and could pay out a special dividend.

* Our invitation to visit Koon was published here: KOON HOLDINGS: "Come visit our facility, meet our management, know our business... and have lunch'

* Our Nov visit to Trek 2000: TREK 2000: Power presentation for NextInsight readers

* Look out for our invitation to visit another promising company in January.