One of China's leading water treatment players, China Everbright Water's water treatment capacity is currently at 4.6 million tons a day. Above: its reservoir for treated water.

One of China's leading water treatment players, China Everbright Water's water treatment capacity is currently at 4.6 million tons a day. Above: its reservoir for treated water.

NextInsight file photo

JUST A MONTH after shareholders approved China Everbright Water’s share buyback program, the water treatment player has spent some S$3.8 million buying back 7.8 million shares from the open market.

It did so over just three days -- 14, 15 and 18 January -- at between 48.5 and 50 cents apiece. All the shares, amounting to 0.3% of its issued share capital, were cancelled.

The share buyback mandate passed last December allows the management to buy back up to 10% of its issued share capital by its next AGM date (late April this year), which will enhance the earnings per share going forward.

The share buyback resolution was passed together with another resolution to reduce its share premium. The share premium reduction enhances its ability to distribute dividends by setting off the credit amount against the accumulated losses from its reverse takeover of Hankore.

This implies there is a chance that the Group may declare a dividend during its upcoming FY2015 results announcement. The last time the Group paid a dividend was in 2007.

| ♦ Insider buying |

|

Former vice-chairman David Chen retains 1.9% interest in China Everbright Water post resignation. Former vice-chairman David Chen retains 1.9% interest in China Everbright Water post resignation.

NextInsight file photoCompany insiders have put their money where their mouth is, in a vote of confidence on the Group’s determination to improve shareholder value through its capital structure tweaks.

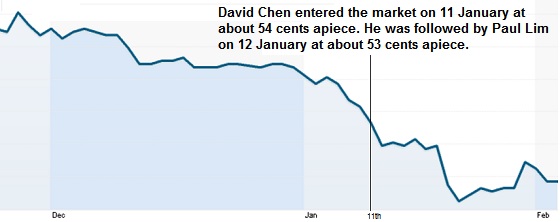

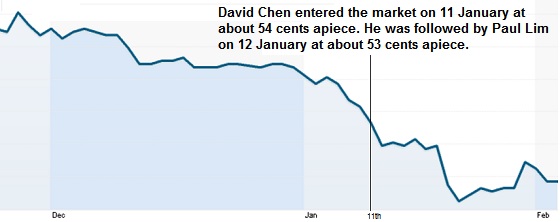

On the 3 days preceding the share buyback transactions, former vice-chairman David Chen as well as non-executive independent director Paul Lim bought S$136,000 worth of China Everbright Water shares from the open market.

They bought on 11, 12 and 13 January at between 50 and 54 cents apiece. That's a lot cheaper than the S$1.14 peak that China Everbright Water's stock price traded at in May 2015.

The share price has been on a steady downward decline, mirroring the general poor market sentiment, especially on S-chips.

The insider purchases send a strong signal of the management’s confidence in the Group’s business prospects, especially since David Chen had purchased the shares just before stepping down from his position as executive director and vice-chairman on 1 February.

China Everbright Water's share price has fallen by some 40% over the past 3 months to 44 cents on 3 February. Reuters data China Everbright Water's share price has fallen by some 40% over the past 3 months to 44 cents on 3 February. Reuters data

The reason cited for Mr Chen’s resignation was that he wanted to spend more time on his other businesses.

Mr Chen became involved with the Group in December 2009 as the white knight who took Bio-Treat out of its debt legacy issue. His wholly-owned investment vehicle, Giant Delight, pumped in HK$367 million (about S$70.6 million) cash to restructure Bio-Treat.

About two thirds of the money was used to pay off the outstanding debt from convertible bonds and the debt was further paid down through a rights issue.

He also brought in anchor investors such as SGX-listed Boustead and sovereign angel investor Suzhou Venture Group.

About a year after Mr Chen’s cash injection, he became the Group's President. In May 2011, when Bio-Treat changed its name to HanKore, he was appointed CEO.

At that time, HanKore had wastewater treatment capacity of only 150,000 tons a day. But by the time of the Group's merger with China Everbright International in 2014, its water treatment capacity had grown to 1.6 million tons a day.

|

HSBC Buy Call, 85ct TP

| CEWL SP |

44.5 ct |

| 52-week range |

41 ct -$1.15 |

| Market cap |

S$1.13 billion |

| Current PE |

15.8 |

On 22 January, HSBC initiated coverage of China Everbright Water with a ‘Buy’ call and target price of 85 cents.

Analyst Thomas Chu cited its promising growth prospect, high proportion of earnings from operations, strong synergy with China Everbright International, impressive management track record and healthy balance sheet as key positives.

One of China's leading water treatment players, China Everbright Water's water treatment capacity is currently at 4.6 million tons a day. Above: its reservoir for treated water.

One of China's leading water treatment players, China Everbright Water's water treatment capacity is currently at 4.6 million tons a day. Above: its reservoir for treated water.