Right away, Anwell is in line to receive a maximum of RMB20.1 million in subsidies for two projects which have been approved by the Ministry of Finance.

Anwell’s total investment for the projects is RMB40.2 million.

By July this year, Anwell expects to complete the projects which involve the setting up of solar panels on the roofs of its factories – in part as a showcase for Anwell’s own solar panels and for in-house testing of its panels.

China’s ‘Golden Sun’ programme, under which the green energy incentives are given, could lead to Anwell clinching Chinese clients as the first buyers of its proprietary manufacturing lines for solar panels.

Being vertically integrated, Anwell develops equipment to manufacture solar panels (the thin-film version, whose market share is expanding) as well as produces the panels.

Anwell’s prospects for selling its solar manufacturing equipment in China are especially promising because of home ground advantage.

Its name is well known in the industry, and there are government subsidies for the purchase of green energy assets by Chinese companies.

So explained Mr Ken Wu, an executive director and the CFO of Anwell Technologies, in a meeting with fund managers and investors on Monday (Mar 1) to brief them on the 2009 financial results of Anwell and its outlook.

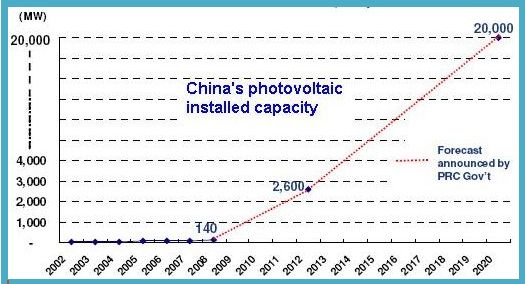

The Chinese incentives are spurring the solar industry in China, which would lead to greater domestic demand for solar panels.

China’s demand for solar panels will, over the next three years, explode with massive investments in solar assets, according to GTM Research, the market research arm of Greentech Media.

Anwell is in the final stages of testing its solar panel manufacturing equipment in Henan, China, and expects to start mass production sometime this month (March).

It expects to achieve a stable conversion efficiency of above 7%, compared with the industry average of 5-6% for amorphous silicon panels. (Conversion efficiency is a measure of electric power output converted from absorbed light).

The major global markets for Anwell’s panels are Europe and the US, rather than China, which is still in its infancy, said Mr Wu.

That is why, in Q4 of last year, Anwell set up a subsidiary in Europe to trade in solar modules (crystalline silicon variety) that it had assembled from cells manufactured by other players, in order to learn more about the industry and to establish contact with potential clients.

The trading contributed HK$54 million in revenue to Anwell, or a significant 25.8% of its Q4 revenue.

On the risks, Mr Wu said: “If the European economy worsens, the government subsidies to the solar industry may be cut. Or if the euro weakens, our products will become more expensive to them.”

For details of Anwell’s 2009 results, go to Singapore Exchange website www.sgx.com

Recent stories:

ANWELL on roadshow to highlight its solar story

ANWELL chairman: "From day 1, I knew we could be successful"